Margin Enhancement with Risk Mitigation

Restructuring advances can lower interest expense, reduce interest-rate risk, and enhance liquidity metrics.

Margin Pressure

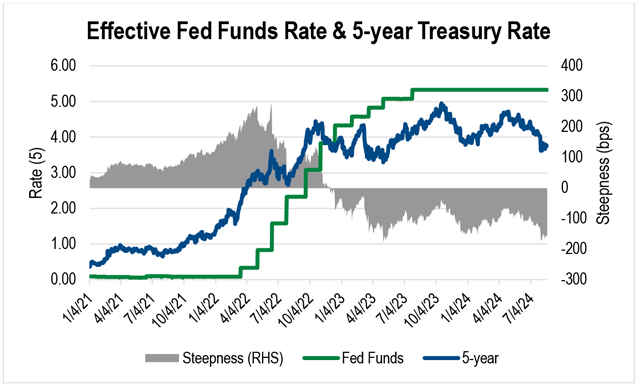

The persistence of the inverted yield curve has put considerable pressure on the net interest margins of FHLBank Boston depository members. As measured by the spread between the Effective Federal Funds Rate and the five-year Treasury yield, the yield curve inverted in November 2022 and has remained that way for over 21 months. Fixed-rate assets put on balance sheets during the low-rate environment in the preceding three years have been slow to reprice, and funding costs have accelerated as short-term rates approached, broke through, and remained above the 5% level.

Recent call report data show some positive signs regarding the magnitude of asset yield improvements. While deposit costs continue to tick higher, the migration from non-maturity deposits to higher-yielding term deposits has slowed. While there are potential tailwinds for margin enhancement at play, there is still a way to go for earnings and risk profiles to return to targeted levels. For example, banks, more often than credit unions, have felt the brunt of the inverted curve’s impact on net interest margin, as the median net interest margin for FHLBank Boston bank members is approximately 70 basis points lower at June 30, 2024, than it was at the end of 2019.

Increased Liability Sensitivity

A common refrain from members has been that interest-rate risk models show them as being more liability sensitive now than they have been historically. Accordingly, many members have extended the term of their borrowings to address these issues. The inverted yield curve has helped rein in interest expense, and supported management of interest-rate risk by adding duration to liabilities. Also, longer-term borrowings have aided liquidity metrics by extending the term of advances. This is particularly important given that many members have seen growth in shorter duration term deposits in their liability mix.

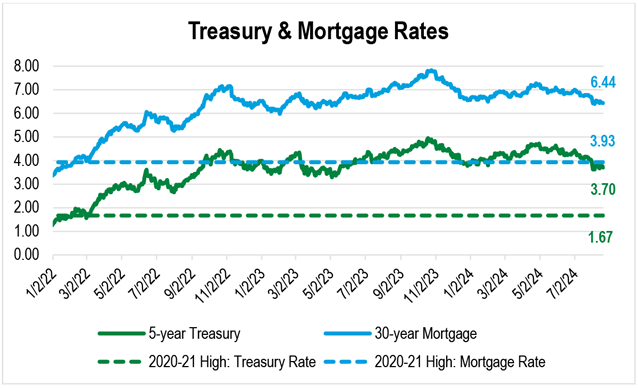

The intermediate part of the yield curve has begun to price in an expected drop in short-term rates. This is evidenced by five-year Treasury rate and 30-year mortgage rate being down approximately 100 basis points from their 2024 highs. While short-term interest rates may ratchet down in the coming months, it’s possible that the belly of the curve may have already completed most of its move.

One strategy members can consider to bolster margin while alleviating liquidity and interest-rate risks is to restructure an existing advance.

One of the key drivers of members’ increased liability sensitivity has been the extension of the average life of mortgage portfolios driven by slower prepayment speeds. Even as longer-term interest rates have come down in 2024, they remain 200 to 250 basis points away from hitting the highest levels seen in 2020 and 2021. Given that dynamic, relative to past cycles, an increase in prepayment speeds leading to an improvement in liquidity and a reduction of interest-rate risk appears less likely to occur at the early stages of a Fed easing cycle.

Advance Restructures

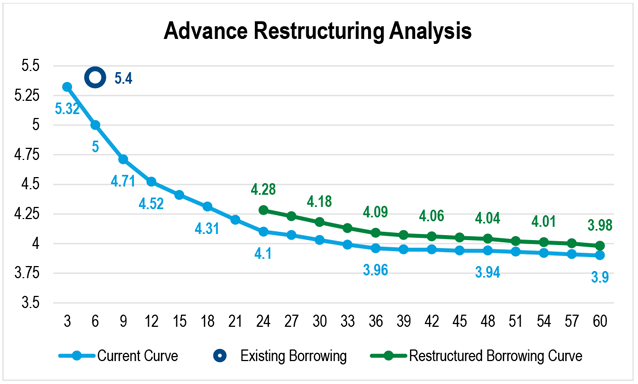

One strategy members can consider to bolster margin while alleviating liquidity and interest-rate risks is to restructure an existing advance. Often referred to as “blend and extend,” an advance restructure involves taking an existing advance and blending the implied prepayment fee into the coupon of the new advance, which has a term longer than the original advance. The net result is that the member can immediately lower the cost of funds while adding liability duration that supports interest-rate and liquidity-risk management.

Consider the example below, where a member has an advance with six months remaining to maturity and a coupon of 5.40%. Because rates have moved lower since the advance was initially established, if the member were to prepay the advance, the member would incur a prepayment fee of approximately 0.34%, impacting the current period’s income statement. However, by restructuring the advance into a new two-year Classic Advance and not taking additional borrowings, the member can take advantage of the lower advance rates over the last few months. If the member chose to extend to the two-year tenor, then the blended rate for that borrowing would be 4.28%, which consists of the 4.10% rate for the current two-year Classic Advance plus the blended prepayment fee spread across the term of the new advance. If the member chose a longer term, then the coupon reduction would be greater due to the inversion of the yield curve and a longer timeframe for the prepayment fee to be spread across.

When evaluating an advance restructure, there are a few things to keep in mind including:

- Some advance types, like the HLB-Option Advance, can be restructured, but the operational process is slightly different than a traditional Classic-to-Classic restructure. In this instance, the member would need to “cash-settle” the existing advance and amortize the fee directly.

- Members can enhance cost savings by utilizing the Community Development Advance as the restructured advance. Please contact your relationship manager about how to qualify for this discounted advance program which helps members support affordable housing and economic development efforts in the communities they serve.

- One popular approach involves effecting an advance restructure to take advantage of asset opportunities that are further out the yield curve than a member might typically target. Adding two to three years of liability duration may allow a member to feel more comfortable when adding the duration that comes with fixed-rate assets within five to seven years.

Flexible Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact me at 617-292-9644 or andrew.paolillo@fhlbboston.com or reach out to your relationship manager for more details.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing.. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.