Finding Value in the MPF® Program

FHLBank Boston’s Mortgage Parternship Finance® (MPF®) 35 product has sharpened its pricing and value proposition at a time when the mortgage business is experiencing challenges due to higher interest rates. Due to some of the nuances of how the product is structured and how prices and price adjustments are made, different opportunities exist for Participating Financial Institutions (PFIs), members participating in the MPF Program, to create more value out of their mortgage activity. In times of constrained liquidity or robust refinancing, the MPF Program could be an attractive arrow in a PFI's quiver.

Overview of the Opportunities

Unlike the more traditional advances business in which members take borrowings against collateral, the MPF Program allows members to obtain liquidity by selling residential mortgages directly to FHLBank Boston.

As with typical sales transactions, a price is paid at delivery. But Participating Financial Institutions (PFIs) – members participating in MPF – have the added bonus of earning Credit Enhancement (CE) income in exchange for retaining some underlying credit exposure to the loans that are sold. Furthermore, that credit exposure, a CE Obligation, is not assessed through points or any kind of hard dollar charge. Instead, that credit exposure is simply held as a lien against a member’s collateral.

The MPF Program, therefore, opens up two significant potential strategies for improving a PFI’s mortgage offering.

First, a PFI could improve the marketability of its products through flexible pricing and the lack of loan level price adjustments (LLPAs). If another secondary market investor requires a LLPA of 2.00% that typically translates into a higher mortgage rate of 0.50%. A PFI could elect not to charge the borrower this additional cost improving the marketability of its mortgage product.

Second, a PFI could elect to do the opposite and charge borrowers for credit-related pricing adjustments and use these funds to ultimately help offset its remaining credit exposure in the MPF Program. If the loans perform over time, the PFI will ultimately simply enjoy these pricing adjustments as additional income.

These product characteristics open up additional possibilities for PFIs to maximize their return for risk assumed.

The Upfront Option Explained

First, PFIs should consider how to maximize their potential CE income. MPF 35 has two different sub-products – a baseline version that offers a larger income stream over the life of the loan sold and an upfront version that offers a larger initial price paid for the transaction.

| Timeframe | MPF 35 | MPF 35 Upfront |

|---|---|---|

| At Sale | Quoted price based on loan product, commitment horizon, loan rate, and current markets | Quoted price + 25 bps (for 30-yr or 20-yr fixed) Quoted price +20 bps (for 15-yr fixed |

| Year 1 | 7 bps | No income |

| Year 2+ | Initial 7 bps plus additional 7 bps based on performance of the loans | 7 bps based on performance of the loans |

The baseline MPF 35 pays the PFI 7 basis points annualized in Year 1 after sale against the outstanding principal and an additional 7 basis points annualized thereafter against the outstanding principal balance of the loans based upon the performance of the loans.

The upfront version of MPF 35 initially pays an upfront price that is 25 basis points higher than the quoted price. The CE income is lower, however; no income stream is paid in Year 1 and a 7 basis points annualized income stream is paid against outstanding principal starting in the 13th month based upon the performance of the loans.

In the case of a sale of 15-year fixed-rate loans, the additional upfront price increase is 20 basis points.

Importantly, these two sub-products allow PFIs to exercise some discretion on their overall potential compensation. Nominally, the extra 25 basis points paid in the upfront product is worth 3.6 years of trailing income (25 bps / 7 bps of CE income). With elevated interest rates, however, that breakeven time horizon swells to just over five years on a present value basis because the 25 bps is assumed to be invested at levels greater than 5% in Year 1, greater than 4% in Year 2, and so forth using today’s path of implied future interest rates.

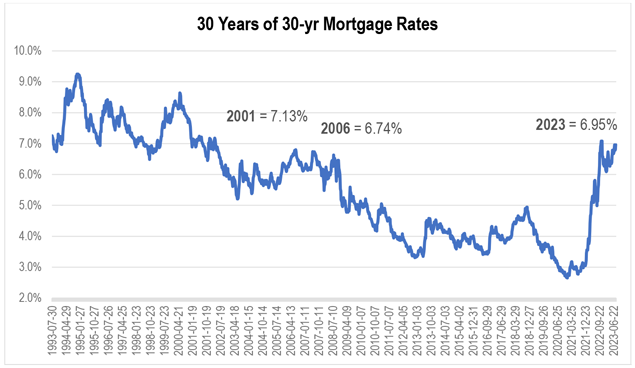

If a PFI believes that there is an elevated chance of newer vintage, higher coupon loans having a shorter life than five years, based on recent prevailing interest rates, that institution could benefit from electing to take the upfront product.

Pockets of Value in Pricing Adjustments

Beyond optimizing for potential life of loans sold, credit-related pricing adjustments offer chances to find value.

As discussed previously, LLPAs mandated by other secondary market investors are a blunt instrument that could reduce the marketability of a PFI’s offering to its borrowers. A look at the costs of particular loan and borrower attributes can help illuminate where opportunities might exist.

Second homes immediately stand out as an opportunity. LLPAs assessed on loans associated with these properties have both the highest average charge and the largest potential range of charges.

Additionally, very wide ranges on the attributes of loan-to-value (LTV) and credit score create opportunity at both ends of the market.

While pricing is always subject to change, lower balance loans often have more attractive pricing than other conventional conforming loans.

If a PFI feels confident about the actual credit risk of higher LTV or lower credit score borrowers relative to what the deterministic, formulaic LLPA grid requires, then MPF 35 could be a better outlet for this activity.

Conversely, if a PFI determines that the changes that were made to flatten the LLPA grid this year – which increased costs to higher credit score borrowers relative to low credit score borrowers – make the former more attractive, MPF 35 could also be a more attractive outlet for this activity.

Lenders in more urban areas may find value in multifamily loans or condos. While these LLPAs are lower, if a PFI feels secure in the creditworthiness of its markets and underwriting, MPF 35 could again allow it to leverage this confidence.

Low Loan Balances = Better Pricing

While pricing is always subject to change, lower balance loans often have more attractive pricing than other conventional conforming loans.

For instance, a traditionally conforming loan with a balance of $500,000 and a rate of 7.00% was recently quoted at 100.97; the same coupon loan with a maximum loan balance of $200,000 would be quoted at 101.30.

Loans with even lower balances garner higher prices. A $150,000 loan balance and a 7.00% rate would be quoted at 101.59. These pricing pay-ups could be another attractive point for consideration for PFIs that originate lower balance mortgages.

Conclusion

MPF 35’s overall potential value relative to competing products could be an opportunity for your institution. Improved product pricing, opportunities to generate additional income, and less competitive value from other providers have proven to be a compelling combination for many banks and credit unions this year in New England.

Flexible Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact Andrew Paolillo at 617-292-9644 or andrew.paolillo@fhlbboston.com, your relationship manager, or our MPF team for more details.

“Mortgage Partnership Finance” and “MPF” are registered trademarks of the Federal Home Loan Bank of Chicago.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing.The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.