Products and Solutions Guide for Housing Associates

Introduction

Building Communities – Building New England

The mission of the Federal Home Loan Bank of Boston is to provide highly reliable wholesale funding and liquidity to its member financial institutions in New England. We deliver competitively priced financial products, services, and expertise that support housing finance, community development, and economic growth, including programs targeted to lower-income households.

Chartered in 1932, the Federal Home Loan Bank of Boston is one of 11 Federal Home Loan Banks across the country. The Bank is a cooperative that serves the six New England states. Our members are our shareholders and our customers, and we are committed to providing members and housing associates with financial products and services that help build vibrant communities within established risk management parameters.

The Products and Solutions Guide for Housing Associates is designed to help housing associates understand and use our products, solutions, services, and pricing. It also provides information about the Bank’s credit and collateral policies and the requirements for accessing those products and services in a safe and sound manner.

About the Guide

The Bank’s board of directors established the Products and Solutions Guide for Housing Associates and reviews and re-adopts it at least annually.

Please note that the Products and Solutions Guide for Housing Associates is also the Bank’s Credit Policy and the Bank’s Products Policy. 1 Accordingly, any reference in any agreement or other document relating to the relationship between the Bank and any housing associate to the Bank’s Credit Policy or the Bank’s Products Policy means the Products and Solutions Guide for Housing Associates. The Bank may change the guide’s terms at any time without prior notice.

The Products and Solutions Guide for Housing Associates is available here.

Each section of this guide includes contact information to direct housing associates to the appropriate personnel at the Bank. A full listing of Bank contacts may also be found at the end of this guide.

Please note: In the event of any conflict between the terms of this Products and Solutions Guide for Housing Associates and any prior versions of the Bank’s Credit Policy or the Bank’s Products Policy for Housing Associates, this Products and Solutions Guide shall control.2

1. The Products and Solutions Guide for Housing Associates serves as the Bank’s Products Policy for Housing Associates in accordance with 12 CFR Part 1239.30.

2. In order for an entity to be eligible to receive financial products from the Bank as a “housing associate,” such entity must meet the eligibility requirements set forth in 12 CFR Part 1264.3 and must apply to the Bank for certification as a housing associate pursuant to 12 CFR Part 1264.5.

Products and Solutions Overview

Credit Products

The Bank offers short-, medium-, and long-term loans known as advances. These advances offer fixed or variable rates and several choices for payment of principal and interest.

The Bank also offers forward commitments to take down advances. Some advances contain embedded options, interest-rate caps, or interest-rate floors. In addition to advances, the Bank offers non-cash credit products such as letters of credit.

Please note that the Bank does not act as a financial adviser, and housing associates should independently evaluate the suitability and risks of our solutions.

Please fully assess these risks and their implications prior to obtaining products from the Bank. We strive to make all maturities available every business day, subject to market conditions.

For more information about our credit products, please contact the Housing and Community Investment team at 800 357-3452, housing@fhlbboston.com , the Member Funding Desk at 800-357-3452, or consult the Products & Programs section of Bank’s website.

The product and solution descriptions that appear in the following pages of this guide are meant as summaries only and do not purport to disclose all risks and other material terms and conditions associated with such products and solutions. Nothing in this guide shall be deemed business, legal, tax, or accounting advice from the Bank. Housing associates are encouraged to consult their own business, legal, and accounting advisers with respect to the Bank’s products and solutions and should refrain from utilizing any of the Bank’s products and solutions unless they have fully assessed the risks and terms.

The Bank’s confirmations for advances are available in Appendix D. A housing associate should review not only this guide, but also the advance confirmation associated with any Bank product or solution prior to utilizing such product or solution so as to understand the terms, including, without limitation, the prepayment provisions.

Overnight Funding

Daily Cash Manager Advance

Description

Overnight funding.

Common Uses

Manage daily liquidity needs.

Terms

One day.

Disbursement

Funds are available the same day.

Principal and Interest

- Principal and interest are due at maturity, which is the next business day.

- Interest is calculated on an actual/360-day basis.

Additional Information

For more information about the Daily Cash Manager Advance, please call your relationship manager or the Member Funding Desk at 800-357-3452.

Rollover Cash Manager Advance

Description

Overnight funding with an automatic rollover at maturity.

Common Uses

Manage daily liquidity needs.

Terms

Maturity is one day, with an automatic rollover to a new one-day advance at the prevailing rate.

Disbursement

Funds are available same day or the next day.

Principal and Interest

- Principal may be paid on a date you choose.

- Payment of interest is due monthly on the second business day of the month.

- Interest is calculated on an actual/360-day basis.

Additional Information

For more information about the Rollover Cash Manager Advance, please call your relationship manager or the Member Funding Desk at 800-357-3452.

IDEAL Cash Manager Advance

Description

Overnight funding using your IDEAL Way Line of Credit.

Common Uses

Manage daily liquidity needs.

Terms

One day.

Disbursement

Funds are available the same day and can be accessed by wiring funds from your IDEAL Way demand account, causing an overdraft.

Principal and Interest

- Principal is due at maturity. Payment of interest is due monthly on the second business day of the month.

- Interest is calculated on an actual/360-day basis.

The IDEAL Way Line of Credit

- The IDEAL Way Line of Credit allows housing associates to access liquidity quickly and conveniently, without call ing the Member Funding Desk.

- It is a fixed amount, typically 2% of assets, and can easily be set up and/or changed by the housing associate by making a request through the Member Funding Desk.

- Housing associates are required to maintain collateral equal to the entire amount of the IDEAL Way Line of Credit, whether used or not.

- For more information about the IDEAL Way Line of Credit, please contact the Member Funding Desk at 800-357-3452 or memberfunding@fhlbboston.com.

Fixed-Rate Advances

Amortizing Advance

Description

A fixed-term and rate advance with an amortizing principal.

Common Uses

Fund short- or long-term assets whose principal balance declines on a monthly basis due to amortization and/or prepayment.

Terms

Maturities available for terms out to 20 years with principal-amortization periods out to 30 years.

Disbursement

Funds will be available the same day if you call by noon and the following day if requested by 3:00 p.m.

Principal and Interest

- Principal and interest are due on the first business day of the month.

- Interest is calculated on an actual/360-day basis.

Prepayment

Advances may be prepaid, subject to a fee. Please see Appendix D to find the confirmation statement, which has additional information on prepayment fees.

Classic Advance

Description

Nonamortizing, fixed-term and rate advance.

Common Uses

- Manage liquidity needs.

- Manage interest-rate risk.

- Fund short- or long-term assets.

Terms

Maturities available for terms out to 30 years.

Disbursement

Funds are typically available the same day if you call by noon. They are available the following day if requested by 3:00 p.m.

Principal and Interest

- Principal is due at maturity and interest is due on the second business day of the month.

- For advances with maturities of one year or less, you may choose to pay principal and interest at maturity. If chosen, the advance rate may be higher than the posted rate.

- For advances with maturities of more than one year, principal is due at maturity and interest is due either monthly, on the second business day of the month, or semiannually. If interest is due semiannually, the advance rate may be higher than the posted rate.

- Interest is calculated on an actual/360-day basis.

Prepayment

Advances may be prepaid, subject to a fee. Please see Appendix D to find the confirmation statement, which has additional information on prepayment fees.

Forward Starting Advance

Description

Lock in current fixed rates and delay funding the advance for up to two years. Classic and Amortizing Advances may be customized to use the forward starting feature.

Common Uses

- Access the current rate environment without adding liquidity.

- Lock in rates for anticipated future funding needs.

- Allow borrowers to lock in rates on loans with future closing dates.

- Manage anticipated deposit runoff or uncertainty in the future.

Terms

Maturities available for terms out to 20 years.

Disbursement

Funding can be delayed for up to two years.

Principal and Interest

- Principal and interest are due based on the terms of the specific advance utilized. Interest begins accruing at disbursement.

- Interest is calculated on an actual/360-day basis.

Additional Information

- Members will be required to collateralize and purchase activity-based capital stock at the time of disbursement.

- For more information about the Forward Starting Advance, including comments on risks, please call the Member Funding Desk at 800-357-3452, for indications on specific structures.

HLB-Option Advance

Description

Nonamortizing, fixed-rate and term advance. The Bank holds the option to cancel the advance on specified dates prior to maturity.

Common Uses

- Generally used in a flat yield-curve environment to obtain a lower cost of funding than a Classic Advance with a maturity equal to the lockout period.

- Fund short- or long-term assets.

Terms

- Maturities available for terms out to 20 years, but always with the condition that the Bank may cancel the advance prior to final maturity.

- There is an initial lockout period during which the Bank cannot cancel the advance. You may choose a lockout period of three months to 10 years.

- We may cancel the advance only on scheduled cancellation dates, after the initial lockout period. The Bank makes no warranties as to the circumstances under which it might cancel an advance.

- The Bank will provide notice of cancellation in writing at least four business days before the cancellation date.

- Some HLB-Option Advances are offered with only one cancellation date. Others are offered with a series of cancellation dates at regular intervals, usually quarterly.

- The minimum offering size is $2 million. Offering size orders for less than $2 million will be aggregated with other requests for advances with identical terms and will be executed when orders total $2 million.

Disbursement

Funds are available two business days after the trade date.

Principal and Interest

- Principal is due at maturity, and interest is due on the second business day of the month.

- If the Bank exercises its option to cancel, you must repay the advance, but you may replace the advance with a new advance. The new advance may be for any structure and term to maturity agreed upon between the housing associate and the Bank. The rate on the new advance will be that in effect at the time the new advance is taken.

- Interest is calculated on an actual/360-day basis.

Prepayment

Advances may be prepaid, subject to a fee. Please see Appendix D to find the confirmation statement, which has additional information on prepayment fees.

Member-Option Advance

Description

Nonamortizing, fixed-term and rate advance. Housing associates have the option to cancel the advance on specified cancellation dates they select.

Common Uses

- Manage interest-rate risk.

- Fund short- or long-term assets.

- Manage exposure to prepayment risk of assets.

Terms

- Maturities are available for terms out to 20 years.

- The housing associates must provide notice of cancellation in writing at least four business days before the cancellation date.

- The minimum offering size is $2 million. Offering size orders for less than $2 million will be aggregated with other requests for advances with identical terms and will be executed when orders total $2 million.

Disbursement

Funds will be available three business days after the trade date.

Principal and Interest

- Payment of principal is due at maturity. Interest is due monthly on the second business day of the month.

- Interest is calculated on an actual/360-day basis.

Prepayment

- Advances may be prepaid in full or in part, on specified cancellation dates with no prepayment fee. Typically, the cancellation dates are the first or third anniversary of disbursement and semiannually thereafter. (Other prepayment structures may be available.)

- Advances may be prepaid, subject to a fee. Please see Appendix D to find the confirmation statement, which has additional information on prepayment fees.

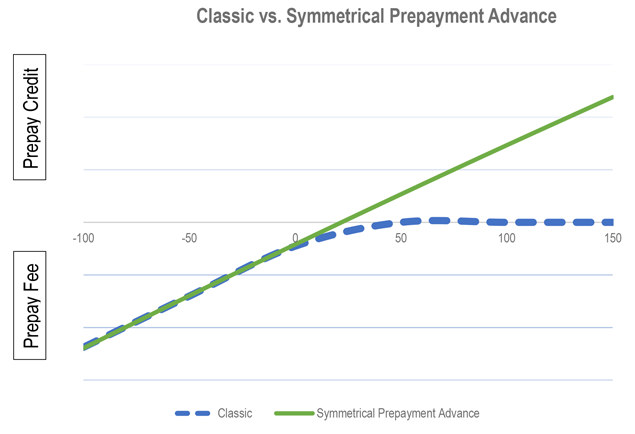

Symmetrical Prepayment Advance

Description

Nonamortizing, fixed-term and rate advance with a special prepayment feature that allows you to prepay the advance at its approximate market value. Any gain will be passed through to the housing associate subject to certain limitations.

Common Uses

- Manage liquidity needs.

- Manage interest-rate risk.

- Fund short- or long-term assets.

- In a rising-rate environment, the gain from prepayment can be used to offset the loss on sale of securities or other assets.

Terms

- Maturities are available for terms out to 20 years.

- The minimum offering size is $2 million. Offering size orders for less than $2 million will be aggregated with other requests for advances with identical terms and will be executed when orders total $2 million.

Disbursement

Funds are available next day.

Principal and Interest

- Payment of principal is due at maturity and interest is due on the second business day of the month.

- Members may choose monthly or semiannual interest payments prior to initiation.

- Interest is calculated on an actual/360-day basis.

Prepayment

- Advances may be prepaid with two business days’ notice to the Bank, in an amount equal to the approximate market value of the advance. Any gain will be passed through to the housing associate subject to certain limitations.

- For further detail, please see the Comparison of Prepayment Profile below.

- Advances may be prepaid, subject to a fee. Please see Appendix D to find the confirmation statement, which has additional information on prepayment fees.

Comparison of Prepayment Profile

Long-Term Variable-Rate Indexed Advances

Callable SOFR-Indexed Floater Advance

Description

Nonamortizing, fixed-term advance with an interest rate that adjusts daily, according to changes in SOFR. Members have the option to cancel the advance on specified cancellation dates they select.

Common Uses

- Manage liquidity needs.

- Fund adjustable-rate assets.

- Manage exposure to declining interest rates.

- Long-term funding commitments at short-term interest rates.

- Manage prepayment risks.

- Reduce funding costs.

Terms

- Maturities are available out to 20 years.

- The minimum offering size is $2 million. Offering size orders for less than $2 million will be aggregated with other requests for advances with identical terms and will be executed when orders total $2 million.

Disbursement

Funds are available two business days after trade date.

Principal and Interest

- Principal is due at maturity. Interest is due quarterly, the following business day after the anniversary date of settlement.

- During the lockout period, rates adjust daily, based on SOFR.

- Rate adjusts daily; Subject to an index floor of 0%.

- Interest is calculated on an actual/360-day basis.

Prepayment

- Advances may be prepaid in full or in part on specified cancellation dates with no prepayment fee. Notice of cancellation must be received no fewer than nine business day prior to a specified cancellation date.

- Advances may be prepaid, subject to a fee, on any date other than a specified cancellation date. Please see Appendix D to find the confirmation statement, which has additional information on prepayment fees.

Discount Note Auction-Floater Advance

Description

Nonamortizing, fixed-term advance with an interest rate that adjusts periodically according to changes in the Federal Home Loan Bank System’s Office of Finance discount note auction rates.

Common Uses

- Manage liquidity needs.

- Fund adjustable-rate assets.

- Manage exposure to declining interest rates.

- Long-term funding commitment at short-term interest rates.

Terms

- Maturities are available in terms out to 20 years.

- The minimum offering size is $2 million. Offering size orders for less than $2 million will be aggregated with other requests for advances with identical terms and will be executed when orders total $2 million.

Disbursement

Funds are available the next day.

Principal and Interest

- Principal is due at maturity. Interest is due on the rate-adjustment date.

- Rates reset every four or 13 weeks, depending on the index you choose, on indicated reset dates, based on the result of the prior day’s discount-note auction.

- Interest is calculated on an actual/360-day basis.

Prepayment

Advances may be prepaid, subject to a fee. Please see Appendix D to find the confirmation statement, which has additional information on prepayment fees.

SOFR Flipper Advance

Description

Nonamortizing, floating-to-fixed-rate advance where the Bank holds the option to cancel the advance on certain specified dates after a specified lockout period. During the lockout period, the advance rate will adjust daily according to changes in SOFR and may be sub-SOFR (the spread to SOFR is determined by the member). If the advance is still outstanding after the lockout period, it will flip to a predetermined fixed rate.

Common Uses

- Generally used in a flat yield curve environment when margins are under pressure.

- Match fund adjustable assets.

- Protects against falling rates.

- Manage interest-rate risk.

- Reduces funding costs.

Terms

- Maturities are available out to 20 years. FHLBank Boston may cancel the advance prior to final maturity.

- You may choose a lockout period of three months to 10 years. We may cancel the advance at the end of the lockout period on a scheduled cancellation date, but not prior. A notice will be provided in writing at least four business days before the cancellation date.

- The Bank makes no warranties as to the circumstances under which we might cancel an advance.

- Certain SOFR Flipper advances are offered with only one cancellation date. Others are available with a series of cancellation dates at regular quarterly or annual intervals.

- The interest rate can reset at a rate less than zero.

- The Bank holds the option to cancel on certain specified dates. If the advance is not cancelled at the end of the lockout period, the advance will convert, or flip into a fixed-rate advance. We may cancel the advance on any subsequent scheduled cancellation date, if any.

- The minimum offering size is $2 million. Offering size orders for less than $2 million will be aggregated with other requests for advances with identical terms and will be executed when orders total $2 million.

Disbursement

Funds are available two business days after trade date.

Principal and Interest

- Principal is due at maturity. Interest is due quarterly, from disbursement date.

- During the lockout period, rates adjust daily, based on SOFR.

- If the Bank exercises its option to cancel, you must repay the advance, but you may replace it with a new advance. The new advance may be for any structure and term to maturity agreed upon between you and the Bank. The rate on the new advance will be that in effect at the time the new advance is taken.

- Interest is calculated on an actual/360-day basis.

Prepayment

Advances may be prepaid, subject to a fee. Please see Appendix D to find the confirmation statement, which has additional information on prepayment fees.

SOFR-Indexed Advance

Description

Nonamortizing, fixed-term advance with an interest rate that adjusts daily, according to changes in SOFR.

Common Uses

- Manage liquidity needs.

- Fund adjustable-rate assets.

- Manage exposure to declining interest rates.

- Long-term funding commitments at short-term interest rates.

Terms

- Maturities are available out to 20 years.

- The minimum offering size is $2 million. Offering size orders for less than $2 million will be aggregated with other requests for advances with identical terms and will be executed when orders total $2 million.

Disbursement

Funds are available two business days after trade date.

Principal and Interest

- Principal is due at maturity. Interest is due annually, two business days after the anniversary date of settlement.

- Rate adjusts daily.

- Interest is calculated on an actual/360-day basis.

Prepayment

Advances may be prepaid, subject to a fee. Please see Appendix D to find the confirmation statement, which has additional information on prepayment fees.

Advance Restructuring

Description

A solution that extends the maturity and reduces the rate of existing advances.

Through this product, housing associates can restructure outstanding advances for certain eligible product types and blend the contractual prepayment fee into the rate of a new long-term advance. There is no cash settlement of the prepayment fee since it is blended into the rate of the new advance. This allows housing associates to extend the maturity of their existing advances at a lower rate on the new advances compared with the rate on the original advances— without taking additional cash.

The Bank will also remodify advances that were restructured more than 12 months ago.

To help you determine whether this product may be beneficial to your institution, please contact the Housing and Community Investment team at 800-357-3452 or email housing@fhlbboston.com.

Advances Pricing

Description

The Bank prices credit products consistently and without discrimination to all housing associates applying for advances, no matter the size of the financial institution. We must also ensure regulatory compliance while making advances profitable in order to meet our financial performance objectives and provide an adequate return to our member shareholders. We strive to provide a rate that is competitive with comparable funding alternatives available to members and housing associates.

We are also prohibited by regulation from pricing our advances below our marginal cost of matching term and maturity funds in the marketplace, including embedded options and the administrative cost associated with making such advances to members and housing associates.

However, we may price advances on a differential basis, such as the creditworthiness of members and housing associates, volume, or other reasonable criteria applied consistently to all members and housing associates. With these regulatory parameters in mind, we price all credit products according to market conditions and the following specific criteria:

- The Bank’s cost of funds;

- The Bank’s cost of delivering products (general and administrative expenses); and

- Bank profitability targets and risk/return objectives.

The Bank’s Asset-Liability Committee establishes minimum spread requirements relative to its funding costs for all products.

Please note that pricing for the Daily Cash Manager advance is primarily based on the federal funds market, which is highly variable and dynamic. As a result, pricing is subject to change more frequently and at irregular intervals compared with other advances products.

Special Advance Offerings

From time to time, the Bank offers scheduled and unscheduled specials on pricing.

In order to promote equal access to “special” pricing to all members and housing associates, we offer specials that approximate those offered for single large transactions.

Our rates are available in real time on our website. Or you may contact the Member Funding Desk at 800-357-3452, memberfunding@fhlbboston.com for rate information.

Letters of Credit

Description

Standby and confirming.

Common Uses

- Credit support for certain tax-exempt and taxable bonds.

- Performance guaranty in lieu of a construction performance bond.

- Collateral for obligations arising pursuant to an interest-rate swap.

- Credit support for other financial obligations.

Terms

- Terms typically available up to 10 years. Terms greater than 10 years may be available on an exception basis.

- For non-Confirming Stand-by Letters of Credit, the beneficiary must be a customer, vendor, or financial counterparty of the housing associate.

Must be used to

- Facilitate residential housing finance or community lending.

- Assist with asset/liability management.

- Provide liquidity or other funding.

Issuance

Issuances vary, depending on complexity.

Additional Information

For further information, go here.

Letters of Credit (LOC) Pricing and Fees

Legal fees and operational expenses incurred on letters of credit may be passed through to the housing associate as a processing fee.

LOC fees are calculated and billed on an actual/360 basis.

See the letters of credit pricing schedule in the Letters of Credit section of our website.

Fees upon draws on a letter of credit made by a beneficiary take into account all direct and indirect costs in satisfying the draw. Fees reflect the imputed rate of return that would have been earned and the taxes that would have been paid if the Bank were a private corporation. They are calculated by applying a cost-of-capital adjustment factor to the assets used in satisfying the draw.

LOC fees are based on the face value of the LOC and are the greater of (a) a minimum dollar fee or (b) a fee based on the face value of the LOC multiplied by a basis points amount per annum determined by the maturity of the letter of credit. In the case of a confirming letter of credit supporting a bond transaction, a one-time processing fee will be added to the fee described previously under (b), and a minimum dollar fee will not apply.

Housing associates should contact the Housing and Community Investment team at 800-357-3452, option 5 or email housing@fhlbboston.com; or the Member Funding Desk at 800-357-3452, or memberfunding@fhlbboston.com for information regarding collateral requirements and pricing for letters of credit.

Asset-Purchase Programs

The Bank participates in the Mortgage Partnership Finance® (MPF®) 1 program, which is an attractive alternative to the traditional secondary market. Through MPF, the Bank purchases eligible mortgages from participating members and housing associates. Members and housing associates originate and service the loans and are paid fees in return for retaining a portion of the credit risk associated with the loans. The Bank manages the interest rate, liquidity, and prepayment risks, as well as a portion of the credit risk of the loans purchased.

We also facilitate the sale of loans to Fannie Mae by participating members through the MPF Xtra® program.

The MPF program is administered by the Federal Home Loan Bank of Chicago. As the MPF Provider, FHLBank Chicago sets base prices, rates, and fees associated with various MPF products using observable third-party pricing sources as inputs to its proprietary pricing model. The Bank has the ability to adjust prices based on various criteria, including volume, credit risk, or level of interest rates. The MPF Provider publishes updated quotations on its secure eMPF® website, www.fhlbmpf.com, during normal business hours. Participating members and housing associates can execute delivery commitments of less than $1 million directly via the website. Larger commitments require a phone call to the MPF hotline 877-463-6673. This practice ensures the accuracy of the price quote. We do not adjust pricing based on the size of the delivery commitment or other factors.

For more information about our asset purchase programs, please contact the MPF team at 800-357-3452.

1. Mortgage Partnership Finance®, MPF ® , MPF Xtra ® , and eMPF ® , are registered trademarks of the Federal Home Loan Bank of Chicago.

Underwriting Requirements

General Requirements

The Bank’s decision to extend credit to a housing associate is based principally on our analysis of the housing associate’s financial condition and outlook, and while we will not extend credit beyond the borrowing capacity afforded by pledged (and discounted) collateral, we may limit lending below such borrowing capacity regardless of the level, value, and quality of the housing associate’s eligible collateral. The Bank is responsible for ensuring that all extensions of credit comply with applicable statutes, Federal Housing Finance Agency regulations, and the Bank’s guidelines.

To protect our cooperative, the Bank monitors each housing associate’s financial condition on a continuous basis to assure that extensions of credit are made in a safe and sound manner. Our primary tools for monitoring include quarterly financial reports, audited financial reports, publicly available reports, and interviews with senior management during periodic financial reviews by the Credit Department.

The Bank reserves the right to not extend credit to any housing associate that the Bank determines, in its sole discretion, fails to meet the Bank’s underwriting guidelines.

Requests for Extensions of Credit

Housing associates may request an extension of credit from the Bank by calling the Member Funding Desk at 800-357-3452. Many borrowing requests may also be completed through the Bank’s online banking system.

Maturity and/or Other Borrowing Restrictions

The Bank’s willingness to extend credit to a housing associate is principally based on the Bank’s assessment of the housing associate’s ability to repay. Further, the Bank may impose maturity and or other borrowing restrictions on a housing associate if the Bank determines that the housing associate’s financial condition presents the Bank with an elevated level of risk (such as if a housing associate fails to comply with any of its regulatory capital requirements), regardless of the level of pledged collateral. Restrictions may also apply to a housing associate that is in receivership, conservatorship, bankruptcy, or under the control of the regulatory entity.

Total Extensions of Credit

A housing associate’s total extensions of credit are generally limited, with potential exceptions, to 40% of its total assets and housing associates must immediately contact the Bank’s Credit Department at 800-357-3452 if this situation occurs. As previously noted, however, the Bank may impose tighter restrictions (e.g., on total exposures and/or advance maturity terms) if the Bank determines a housing associate presents elevated risk.

Material Adverse Event

Each housing associate is required to immediately call the Credit Department (800-357-3452) to notify the Bank of any material adverse event and then follow up in writing detailing the event. A “material adverse event” is one or more of the following:

- The occurrence of any event or series of events with the cumulative effect of adversely impacting the business, operations, properties, assets, or condition (financial or otherwise) of such housing associate or any of its affiliates;

- The impairment of such housing associate’s ability to perform its obligations under its advances agreement or other agreements with the Bank; and

- The impairment of the Bank’s ability to enforce its rights under the advances agreement or other agreements with such housing associate.

Additional Information

For additional information on the Bank’s underwriting requirements, please contact your relationship manager or the Credit Department at 800-357-3452.

Collateral Requirements

Each housing associate is required to pledge sufficient eligible collateral to secure advances (both new and outstanding), lines of credit, letters of credit, and other amounts payable to the Bank.

In the true spirit of our cooperative, the Bank’s robust collateral requirements are in place to protect our financial and regulatory positions. Every housing associate is required to pledge the required amount of eligible collateral to secure all extensions of credit from the Bank. The following collateral requirements are in place to help ensure that the Bank remains in compliance with all statutes and regulations. Please direct any questions regarding the Bank’s collateral requirements to the Collateral Department at 800-357-3452 or email collateral@fhlbboston.co.

Collateral Requirements

Finance Agency regulations require that all extensions of credit from the Bank to housing associates be fully secured by eligible collateral at all times. The Finance Agency regulations also identify the general types of assets that the Bank may consider as eligible collateral. Housing associates are required to pledge eligible collateral to use the Bank’s credit products.

Eligible Collateral

Eligible collateral includes:

- Cash on deposit at the Bank that is specifically pledged to the Bank as collateral

- Fully disbursed whole first-mortgage loans on one- to four-family residential property insured under Title II of the National Housing Act

- Securities representing a whole interest in the principal and interest payments due on a pool of fully disbursed whole first mortgages on one- to four-family residential property insured under Title II of the National Housing Act

- In addition to the collateral described above, the Bank may make an advance to a state housing associate upon the security of the collateral noted in Appendix A. The advance must be for the purpose of facilitating residential or commercial mortgage lending that benefits individuals or families meeting the income requirements in Section 142(d) or 143(f) of the Internal Revenue code. Prior to obtaining the advance, the state housing associate must submit a written certification that it will use the proceeds of the advance for this purpose.

Conditions to the Bank’s Acceptance of Collateral

In general, in order for the Bank to accept an asset constituting eligible collateral, among other things, each of the following conditions must be met:

- The asset must be owned by the housing associate free and clear of all other liens or claims, including UCC filings and other pledge and security agreements.

- The asset must not have been in default within the most recent 12-month period, except that whole first mortgage loans on owner-occupied one- to four-family residential property are eligible collateral, provided that no payment is overdue by two or more payments.

- Mortgages and other loans are considered eligible collateral, regardless of delinquency status, to the extent that the mortgages or loans are insured or guaranteed by the U.S. government or agency thereof.

- The asset must not be classified as substandard, doubtful, or a loss by the housing associate or the housing associate’s regulatory authority or reported as troubled debt restructuring.

- The asset must not be encumbered by private transfer fee covenants, including securities backed by such mortgages and securities backed by the income stream from such covenants — except for certain allowed transfer fee covenants. (Contact the collateral staff if you have questions.)

- The asset cannot secure indebtedness – including mortgages – on which any director, officer, employee, attorney, or agent of the housing associate or of any Federal Home Loan Bank is personally liable.

- The asset must comply with the Subprime and Nontraditional Loan Guidelines as detailed in Appendix C.

A residential mortgage loan 1 that is secured by the borrower’s primary residence — whether pledged individually or as part of a private-label (nonagency) MBS — will not be accepted as collateral if it meets one or more of the following criteria:

- The annual interest rate and/or points and fees charged for the loan exceed the thresholds of the Home Equity Ownership Protection Act of 1994 2 (HOEPA);

- The loan has been identified by a housing associate’s regulator as possessing predatory characteristics;

- The loan includes prepaid, single-premium credit insurance;

- The loan is defined as a High-Cost Loan, Covered Loan, or Home Loan, generally categorized under one or more federal, state, or local laws as having certain potentially predatory characteristics;

- The loan includes penalties in connection with the prepayment of the mortgage beyond the early years of the loan; or

- The loan requires mandatory arbitration to settle disputes.

Please direct any questions regarding the Bank’s collateral requirements to the Collateral Department at 800-357-3452 or collateral@fhlbboston.com.

The Bank reserves the right, in its sole discretion, to refuse to accept certain assets as collateral, including, without limitation, assets constituting eligible collateral.

1. A “residential mortgage loan” is a mortgage loan secured by a one-to-four-family residential property. For the Bank’s purposes, the definition includes mortgage loans and home equity loans and open-ended home equity lines of credit, including those secured by junior liens

2. The applicable thresholds are noted in Truth in Lending – Regulation Z -12 CFR 226.32.

Collateral Maintenance Level

The amount of collateral that a housing associate is required to maintain with the Bank at all times is referred to as its collateral maintenance level. Unless otherwise specified in writing by the Bank to the housing associate, a housing associate’s collateral maintenance level is the aggregate amount of eligible collateral, as defined in this guide and accepted by the Bank, that has a valuation equal to the aggregate amount of the Bank’s extensions of credit to the housing associate. When determining that a housing associate has met its collateral maintenance level, the Bank applies a collateral valuation discount (haircut) to all eligible collateral based on the Bank’s analysis of the risk factors inherent in the collateral. The Bank reserves the right, in its sole discretion, to adjust collateral discounts applied.

In the event that the value of a housing associate’s eligible collateral acceptable to the Bank becomes insufficient to satisfy the housing associate’s collateral maintenance level, including, without limitation, due to market depreciation, loan amortization or loan payoffs, the housing associate is required to pledge additional eligible collateral acceptable to the Bank so that the aggregate amount of the housing associate’s eligible collateral acceptable to the Bank is sufficient to satisfy the collateral maintenance level.

All fees and costs incurred by the Bank in connection with its collateral requirements may be charged to the housing associate.

The specific types of eligible collateral, additional conditions to the Bank’s acceptance of collateral, and the related percentages of book value, market value, or unpaid principal (as applicable) applied to collateral are discussed in more detail in Appendix A to this guide.

Collateral Pledging Requirements

Housing associates must deliver all pledged collateral to the Bank

Housing Associates’ Collateral Pledging Requirements and Specific Collateral Recordkeeping Requirements

- Are required to deliver to the Bank an amount of eligible collateral, acceptable to the Bank, sufficient to satisfy the collateral maintenance level along with any required assignment of collateral to the Bank.

- May not use, commingle, encumber, or dispose of collateral that has been assigned and delivered without the express written consent of the Bank.

- Are required to segregate on site and mark as property of the Bank all ancillary documents that pertain to collateral that has been delivered to the Bank.

- Are required to notify the Bank of the acceptance of proceeds from the repayment of notes pledged to the Bank as collateral. The Bank may require the delivery of an amount of collateral equal to the proceeds of the repayment of the notes into a collateral account to secure the housing associate’s indebtedness to the Bank.

- Agree to permit Bank personnel to conduct periodic on-site reviews to verify listed collateral that is pledged.

Additional Collateral Requirements

The Bank reserves the right to take any and all actions to protect its security position and assure compliance with this guide should the Bank identify potential risks. Such actions may include but are not limited to, requiring the delivery of additional collateral, whether or not such additional collateral would be deemed eligible collateral pursuant to this guide, and requiring a housing associate to complete further steps to perfect the Bank’s security interest in the housing associates’ pledged collateral. At the request of the Bank, each housing associate agrees to execute, deliver to the Bank, and/or record, as applicable, such instruments, assignments, and other documents and to take other actions necessary or desirable to evidence, preserve and/or protect the security interest of the Bank in the collateral.

Please direct any questions regarding the Bank’s collateral requirements to the Collateral Department at 800-357-3452 or collateral@fhlbboston.com.

Appendices

Appendix A – Eligible Collateral and Collateral Valuation for Housing Associates

As noted, eligible collateral for housing associates includes:

- Cash on deposit at the Bank that is specifically pledged to the Bank as collateral

- Fully disbursed whole first-mortgage loans on one- to four-family residential property insured under Title II of the National Housing Act

- Securities representing a whole interest in the principal and interest payments due on a pool of fully disbursed whole first mortgages on one- to four-family residential property insured under Title II of the National Housing Act

In addition to the collateral described above, the Bank may make an advance to a housing associate upon the security of the collateral in this Appendix A. The advance must be for the purpose of facilitating residential or commercial mortgage lending that benefits individuals or families meeting the income requirements in Section 142(d) or 143(f) of the Internal Revenue Code. Prior to obtaining the advance, the housing associate must submit a written certification that it will use the proceeds of the advance for this purpose.

The assets listed below constitute the Bank’s eligible collateral types.

The Bank may, in our sole discretion, refuse certain collateral or adjust collateral discounts or valuations based on:

- The financial condition of the housing associate.

- The review of the overall quality and volatility of the value of the collateral pledged. We make this determination based on the result of on-site collateral reviews and our risk analysis.

The Bank will determine market value for all types of collateral at its sole discretion and may determine to value collateral at the unpaid principal balance. Residential one- to four-family owner-occupied loans must not be delinquent by two or more payments. All other eligible collateral must not have been in default within the most recent 12-month period.

The following tables summarize the types of assets the Bank accepts as eligible collateral and the valuation that we generally apply for collateral purposes. The Bank accepts four categories of eligible collateral: cash, securities, residential first-mortgage loans, and other real estate-related collateral.

Any additional deposits, if pledged to the Bank as collateral for advances, will likewise reduce collateral requirements on a dollar-for-dollar basis.

Please contact the Collateral Department at 800-357-3452 or collateral@fhlbboston.com if you have questions regarding eligible collateral.

| Eligible Collateral | Valuation | Comments |

|---|---|---|

| Cash | 100% of balance | Cash must be on deposit in a collateral account at the Bank |

Securities Collateral

- All housing associates are required to deliver to the Bank all securities pledged as collateral for the Bank’s extensions of credit.

- The Bank does not accept as collateral derivatives of eligible securities that contain excessive interest-rate and/or other financial risk, including, but not limited to, interest-only or principal-only strips of securities, residual or “Z” tranches of collateralized mortgage obligations, Inverse Floaters, and/or bonds without principal priority (e.g., PAC -2). Strips of U.S. Treasury securities are accepted as collateral.

- The Bank does not accept as collateral securities that are backed by properties encumbered by private transfer fee covenants, and securities backed by the income stream from such covenants, except for certain allowed transfer fee covenants.

| Eligible Collateral | Valuation: Percent of Market Value |

|---|---|

| U.S. Government and Agency Securities (excluding FNMA, FHLMC, and GNMA Mortgage Backed Securities (MBS)). | By remaining term to maturity 0<3 years: 90% 3<5 years: 87% 5<8 years: 84% 8<10 years: 79% 10<15 years: 72% 15<20 years: 65% 20<25 years 60% 25+ years: 56% |

| U.S. Government and Agency STRIPS | By remaining term to maturity 0<3 years: 90% 3<5 years: 87% 5<8 years: 81% 8<10 years: 79% 10<15 years: 69% 15<20 years: 61% 20<25 years 54% 25+ years: 50% |

| GNMA, FNMA and FHLMC MBS, and Agency CMOs | By structure Floating Rate (under rate cap): 96% Pass-Throughs, by remaining term: < 10 years: 86% 10<20 years: 82% 20 years+: 79% Residential CMO: 77% Agency CMBS: 73% GNMA HECM Bonds 92% |

Residential First-Mortgage Loans

Definition of Owner-Occupied Principal Residence: Loans secured by owner-occupied dwellings. An owner occupied dwelling is the borrower’s primary residence. First lien owner-occupied residential loans are included in this section. (Second liens on owner-occupied residences are included as other real estate-related collateral).

Definition of Non-Owner-Occupied Residence: Second homes, vacation homes, or other investor type properties. These loans must be listed. First liens on non-owner-occupied loans are included in this section. Please note: Second liens on non-owner-occupied residences are ineligible as collateral.1

Other Eligibility Guidelines

- Eligible residential first-mortgage loan collateral that becomes subject to a superior lien, including, but not limited to tax liens, mechanics liens, UCC filings or any other encumbrance, loses its eligibility.

- Eligible residential first-mortgage loan collateral must not be delinquent by two or more payments.

- Eligible residential first-mortgage loan collateral may not be classified as substandard, doubtful, loss by the housing associate or by its regulator, or reported as troubled debt restructuring.

- Eligible residential first-mortgage loan collateral may not include loans to officers, directors, employees, attorneys, or agents of the housing associate or the Bank.

- Eligible residential first-mortgage loan collateral must not be encumbered by private transfer fee covenants — except for certain allowed transfer fee covenants. (Contact the collateral staff if you have questions.)

- Eligible residential first-mortgage loan collateral with loan-to-value (LTV) ratios over 90% (with the exception of Loans insured under Title II of the National Housing Act, i.e., insured by the FHA) must have private mortgage insurance.

- Loans must fully comply with either or both, as applicable, the Interagency Guidance on Nontraditional Mortgage Product Risks issued by the FFIEC on October 4, 2006, and/or the Statement on Subprime Mortgage Lending Risks dated July 10, 2007, to be eligible as collateral.

- Loans that allow for negative amortization of the principal balance, including pay-option adjustable-rate mortgage loans, and home equity conversion mortgages (also known as “reverse mortgages”) are not eligible as collateral.

- Loans for which the borrower’s ability to service the debt is not evidenced by written documentation may only be pledged if the housing associate is providing the Bank with loan level data for all of its pledged residential one- to four-family loan collateral.

- Fully disbursed, closed-end home equity loans secured by first liens on owner-occupied, one- to four-family residential real estate are included within this section for one- to four-family mortgage loan collateral. However, home equity loans secured by junior liens, or home equity lines of credit (HELOCs) – whether secured by first liens or junior liens on one- to four-family residential property – are considered other real estate-related collateral for purposes of this guide.

1. In the event the primary borrower of a loan originated as an owner-occupied primary residence ceases to occupy the subject property, the loan will be considered non-owner-occupied.

Other Eligibility Guidelines (specific to fully disbursed, whole first mortgages secured by residential, owner-occupied one- to four-family manufactured housing property):

In addition to the eligibility requirements for residential first-mortgage loans listed above, to be considered as eligible collateral, manufactured housing loans must meet the following additional requirements:

- The manufactured housing must be located in a state where applicable state law defines the purchase or holding of manufactured housing as the purchase or holding of real property,

Please note that the Bank may require that a housing associate that seeks to pledge loans secured by manufactured housing as collateral deliver to the Bank a legal opinion in form and substance satisfactory to the Bank’s legal department demonstrating that the forgoing requirement has been satisfied.

- Be on land owned by the borrower consistent with existing requirements for one- to four-family site-built homes (i.e., the borrower must own the home and the underlying land);

- Be permanently affixed or anchored to a foundation, connected to utilities, and any wheels, axles, and trailer hitches removed;

- The mortgage must include both the land and improvements ― including the manufactured home; and

- Loan documentation must include the make, model, and serial identification number on the mortgage and all other requirements necessary to perfect a lien on such property.

Note: If you plan to pledge eligible manufactured housing one- to four-family residential loans as collateral, please contact the Collateral Department at 800-357-3452 or collateral@fhlbboston.com for specific pledging instructions.

| Eligible Collateral | Valuation | Comments |

|---|---|---|

| Fully disbursed whole first mortgages secured by owner occupied one- to four-family residential property | Up to 82% of the lower of market value or unpaid principal balance | Borrowing capacity from eligible subprime loans is limited to an amount no greater than the lesser of: (i) one half the housing associate’s total collateral borrowing capacity; or (ii) two times the housing associate’s most recently reported GAAP capital amount. Note: Subprime mortgage loans are defined in accordance with Appendix C of this guide. |

| Fully disbursed whole first mortgages secured by owner occupied one- to four-family residential property fully insured by the FHA | Up to 90% of the lower of market value or unpaid principal balance | N/A |

| Mortgages or other loans, with the exception of SBA and USDA loans, regardless of delinquency status, to the extent that the mortgages or loans are insured or guaranteed by the U.S. or any agency thereof | 82% of the lower of market value or unpaid principal balance | Insurance or guaranty must be for the direct benefit of the housing associate pledging the mortgage or loan as collateral. The Bank must be able to perfect its security interest in the insurance guarantee on such loans. The Bank does not accept loans guaranteed by SBA or USDA as collateral because the Bank is not able to perfect its security interest in the guarantee of these loans. |

| Fully disbursed whole first mortgages on residential, owner-occupied one- to four family manufactured housing property | Up to 82% of the lower of market value or unpaid principal balance | Borrowing capacity from eligible subprime loans is limited to an amount no greater than the lesser of: (i) one half the member’s total collateral borrowing capacity; or (ii) two times the member’s most recently reported GAAP capital amount. Subprime mortgage loans are defined in accordance with Appendix C of this guide. |

| Fully disbursed whole first mortgages on non-owner occupied one- to four-family residential property | Up to 82% of the lower of market value or unpaid principal balance | N/A |

| Fully disbursed whole first mortgages secured by residential property of five or more units Fully disbursed whole first mortgages secured by residential property of five or more units insured by the FHA | Up to 76% of the lower of market value or unpaid principal balance Up to 90% of the lower of market value or unpaid principal balance | Requires review and acceptance by the Bank before pledging. |

Other Real Estate-Related Collateral

- In addition to the eligible collateral, the Bank may make an advance to a housing associate that has satisfied the requirements of section 1264.3(b) for the purpose of facilitating residential or commercial mortgage lending that benefits individuals or families meeting the income requirements in section 142(d) or 143(f) of the Internal Revenue Code (26 U.S.C. 142(d) or 143(f)) upon the security of the collateral noted in Appendix A.

- Other real estate-related collateral must have a readily ascertainable value, the Bank must be able to perfect a security interest in this collateral, and the Bank must be able to sell the property in a reasonable time frame if liquidation of collateral is necessary.

- Other real estate-related collateral is limited up to two times the housing associate’s GAAP capital.

- Other real estate-related collateral must meet the other eligibility requirements for residential loans as outlined in this guide. Please reference the Bank’s Collateral Pledging Guidelines for more information.

- Other real estate-related collateral must be reviewed and accepted by the Bank prior to pledging as eligible collateral.

- If accepted, the housing associate must provide the Bank with a specific loan level listing for accepted loans at least quarterly and more often as determined by the Bank.

| Eligible Collateral | Valuation | Comments |

|---|---|---|

| Fully-disbursed second-lien home equity loans and first- or second-lien home equity lines of credit (HELOCs) secured by the borrower’s primary residence. | 50% of unpaid principal balance (the balance drawn by the borrower in the case of a line of credit) | Must be secured by the borrowers’ primary residence. The combined loan-to-value ratio (CLTV) of the loan cannot exceed 80%. All other home equity loans and HELOCs are not considered eligible collateral. The Bank calculates CLTV by adding the loan balance, or, in the case of HELOCs, the maximum amount of the line of credit to the first lien loan balance and dividing the total amount by the appraised value of the residence. |

| Fully disbursed whole first mortgages secured by commercial real estate | Up to 68% of the lower of market value or unpaid principal balance as determined by the Bank. | All commercial real estate loans are accepted as collateral at the Bank’s discretion. Commercial real estate loans with any connection to a marijuana related business (MRB) are not eligible to be pledged as collateral. In some cases, housing associates may have commercial real estate loans that are secured with higher-risk property types, such as those with potential environmental risks, single- or special purpose properties, or properties that have limited improvements. These loans may have limited marketability and are generally not considered eligible collateral. Commercial real estate loans funded through the Bank’s Affordable Housing Program may be acceptable as collateral, provided the loans meet the eligibility requirements described above. Please contact the Bank’s Collateral Department at 800-357-3452 or email collateral@fhlbboston.com for further information. |

| Eligible Collateral | Rating2 | Term to Maturity | Valuation3 |

|---|---|---|---|

| Commercial Mortgage Backed Securities 1 | AAA | Less than five years | 75% of market value |

| Commercial Mortgage Backed Securities 1 | AAA | Five years or greater | 65% of market value |

| Commercial Mortgage Backed Securities 1 | AA | Less than five years | 70% of market value |

| Commercial Mortgage Backed Securities 1 | AA | Five years or greater | 60% of market value |

2. The lowest rating by either Moody’s, S&P, or Fitch will be used to consider eligibility.

3. For securities issued / sponsored by the pledging housing associate or an affiliate thereof, the above valuations are reduced by 5%.

In addition to the criteria provided in the table above, the following criteria must also be met for CMBS to be deemed eligible collateral:

- Domestic CMBS deals only with a maximum threshold of 15% for any single loan or single borrower in the pool of collateral;

- Securities can be publicly or privately traded, provided, however, that private placement securities must be issued under rule 144A;

- A daily market price must be available from the Bank’s custodian, Citibank, or an approved third-party custodian, and cash flows must be available for ongoing monitoring/modeling for the Bank to accept the CMBS as collateral;

- Minimum of 25 loans in the issue;

- Only senior tranches;

- All loans securing the bond must be secured by a first mortgage (no junior liens);

- Maximum weighted average LTV of 80% within the deal; and minimum weighted average DSCR of 1.20X.

CMBS with the following characteristics will be deemed ineligible to be pledged as collateral:

- Single property, or single borrower;

- Deals without a CUSIP for pricing;

- CMBS denominated in a currency other than U.S. dollars;

- Deals secured by land-only loans;

- Subordinate tranches such as mezzanine and junior tranches (AM, AJ, class, etc.);

- Securities that represent a share of only the interest payments or the principal payments from the underlying loans; and

- Any CMBS that has experienced interest payment shortfalls or that allows for the deferment of interest payments if there is a shortfall in cash flows (Available Funds Class).

The Bank will review each CMBS pledged and reserves the right to reject collateral for any reason.

| Eligible Collateral | Valuation by Remaining Term (applied to Market Value)1 | Comments |

|---|---|---|

| Municipal Securities | 0 < 5: 70% 5 < 10: 60% 10+ : 50% | 1The valuation percentages are for bonds with issuance sizes greater than or equal to $25 million. For issuances greater than or equal to $5 million and less than $25 million, valuations are reduced by five percentage points. |

- Municipal securities fall under the other real estate-related collateral (ORERC) category. All collateral pledged under the ORERC category is limited to a discounted amount up to two times the member’s GAAP Capital.

- The municipal security must identify at least some portion of its proceeds used to finance the acquisition, development, or improvement of real estate (a “real estate nexus”)

- Documentation substantiating the real estate nexus must be provided by the Housing Associate;

- Bonds with issuance sizes greater than or equal to $25 million:

- Must have a rating from at least two of the following NRSROs: Moody’s, S&P, Fitch or Kroll;

- Long-term rating of A3/A- or better and equivalent Securities Valuation Office rating (for insurance company member assets); and

- Bonds rated A3/A- cannot be on negative watch by an NRSRO.

- Bonds with issuance sizes greater than or equal to $5 million and less than $25 million:

- Must have at least one rating from the following Moody’s, S&P, Fitch or Kroll; and

- Long-term rating of Aa2/AA or better.

- If split rating, the lowest of the ratings is used;

- An implied rating is acceptable only in the case where credit enhancement is in the form of underlying government or agency securities;

- Securities have to be publicly registered and publicly traded;

- A daily market price must be available from the Bank’s custodian, Citibank, or the approved third-party custodian.

Municipal securities with the following characteristics will be deemed ineligible to be pledged as collateral:

- IO, PO (zero coupon), leased backed, tender option bond (TOB), variable rate demand note (VRDN);

- No private placement securities1. Only securities with offering codes of competitive, limited, or negotiated are eligible;

- Certificate of participation, variable rate product or short-term product that involves auction rate;

- Third-party support/enhancement other than US government/agency collateralized;

- Following types of revenue bonds: Pension obligation, Tobacco settlement, Special revenue/assessment, Tax increment/allocation, and Industrial development.

1. Defined as a primary offering in which a placement agent sells a new issue of municipal securities on behalf of the issuer directly to investors on an agency basis rather than by purchasing the securities from the issuer and reselling them to investors. Investors purchasing privately placed securities often are required to agree to restrictions as to resale and are sometimes requested or required to provide a private placement letter to that effect.

The Bank supports the expansion of fair and equitable homeownership opportunities. To discourage predatory lending practices, which are inconsistent with such opportunities, and to protect the Bank from potential liabilities, the Bank has established the following anti-predatory lending policy (“APL Policy”) with respect to residential mortgage loans and securities backed by residential mortgage loans pledged by housing associates to it as collateral (“Residential Mortgage Collateral”).

Appendix B – Anti-Predatory Lending Policy

All housing associates must file an anti-predatory lending statement with the Bank as a requirement for borrowing.

The Bank requires that Residential Mortgage Collateral comply with applicable federal, state, and local anti-predatory lending laws and other similar credit-related consumer protection laws, regulations and orders designed to prevent or regulate abusive and deceptive lending practices and loan terms (collectively, “Anti-Predatory Lending Laws”). For example, Anti-Predatory Lending Laws may prohibit or limit certain practices and characteristics, including, but not limited to the following:

- Requiring the borrower to obtain prepaid, single-premium credit life, credit disability, credit unemployment, or other similar credit insurance;

- Requiring mandatory arbitration provisions with respect to dispute resolution in the loan documents; or

- Charging prepayment penalties for the payoff of the loan beyond the early years of such loan.

Any Residential Mortgage Collateral that does not comply with all applicable Anti-Predatory Lending Laws will be ineligible as collateral to support advances or other activity with the Bank. Additionally, the Bank will not give collateral value for any residential mortgage loans on owner-occupied property, whether pledged individually or as part of a private-label (non-agency) MBS, if it meets one or more of the following criteria:

- The annual interest rate and/or points and fees charged for the loan exceed the thresholds of the HOEPA;

- The loan has been identified by a housing associate’s primary federal regulator as possessing predatory characteristics;

- The loan includes prepaid, single-premium credit insurance;

- The loan is subject to state and/or local laws where one or more of the major credit-rating agencies (Standard and Poor’s, Moody’s Investors Service, and/or Fitch Ratings) will not rate a security (or securities) in which the underlying collateral pool contains such a loan; or

- The loan is defined as a High-Cost Loan, Covered Loan, or Home Loan, as are loans categorized under one or more federal, state, or local predatory lending laws as having certain potentially predatory characteristics.

- The loan includes penalties in connection with the prepayment of the mortgage beyond the early years of the loan.

- The loan requires mandatory arbitration to settle disputes.

Housing associates are responsible for avoiding all unlawful practices and terms prohibited by applicable Anti Predatory Lending Laws, regardless of whether they originate or purchase the Residential Mortgage Collateral being pledged to the Bank. The Bank will take those steps it deems reasonably necessary in order to confirm or monitor housing associates’ compliance with this policy. The Bank will adopt procedures to monitor for housing associate compliance with this APL Policy which will:

- Ensure that all housing associates have executed the representation and warranty certification;

- Review housing associate regulator exam reports for findings pertaining to fair lending and/or abusive lending practices;

- Monitor housing associate regulator alerts for newly issued supervisory agreements, memoranda of understanding, or cease and desist orders pertaining to unfair lending and/or abusive lending practices;

- If abusive lending issues are identified by the housing associate’s regulator, or if, Bank staff identifies APL abuses then the housing associate will be required to undertake a review of its policy and procedures for compliance with the Bank’s collateral policies. At its discretion, the Bank may permit such a review to be conducted by the housing associate’s internal auditor or the Bank may choose to conduct the review itself or use a third party, at the expense of the housing associate.

In addition, the Bank reserves the right to require evidence reasonably satisfactory to the Bank that Residential Mortgage Collateral does not violate applicable Anti-Predatory Lending Laws. With respect to Residential Mortgage Collateral purchased by the housing associate, the housing associate is responsible for conducting due diligence that it deems sufficient to support its certification and indemnification agreements with the Bank. In addition to the terms and conditions of the Bank’s Advances and Security Agreement (“Advances Agreement”), each housing associate must execute a Certification agreement with the Bank that: (1) certifies its understanding and compliance with the Bank’s APL Policy and all applicable Anti-Predatory Lending Laws; and (2) certifies it will maintain qualifying collateral and will (a) substitute eligible collateral for any Residential Mortgage Collateral that does not comply in all material respects with applicable Anti-Predatory Lending Laws or this APL Policy; and (b) indemnify, defend and hold the Bank harmless from and against all losses, damages, claims, actions, causes of action, liabilities, obligations, judgments, penalties, fines, forfeitures, costs and expenses, including, without limitation, legal fees and expenses, that result from the pledge of any Residential Mortgage Collateral that does not comply in all material respects with applicable Anti-Predatory Lending Laws or this APL Policy.

The Bank will not knowingly accept as eligible collateral Residential Mortgage Collateral that violates applicable Anti Predatory Lending Laws or this APL Policy. If the Bank knows or discovers that such Residential Mortgage Collateral violates applicable Anti-Predatory Lending Laws or this APL Policy, the Bank may, in addition to all available rights and remedies at law or in equity (1) require the housing associate to substitute eligible collateral, (2) value such Residential Mortgage Collateral at zero for collateral purposes, and (3) require the housing associate to undertake a review of its policies, practices, and procedures for complying with the Bank’s collateral policies.

Appendix C – Subprime and Nontraditional Loan Guidelines

The purpose of these guidelines is to establish the risk-management guidelines and exposure limits around subprime and nontraditional mortgage loans accepted as collateral for advances by the Bank.

Definitions

- A “subprime loan” is a loan where the representative FICO score of any borrower relied upon as a source of repayment for the loan is 660 or lower. The representative FICO score is the one most recently obtained by the housing associate. If the housing associate obtains two FICO credit scores for a borrower, the lower of the two scores is the representative FICO score.

- If the housing associate obtains three FICO scores for a borrower, the middle score is the representative FICO score. When there are multiple borrowers, determine the applicable representative score for each individual borrower (as above) and select the lowest applicable score from the group of borrowers as the representative credit score for the mortgage.

- The FICO score is the primary means by which the Bank identifies a subprime loan. The FICO score should be used to identify a subprime loan whenever possible. In some cases, a FICO score is not available. In these cases, the Bank defines a subprime loan as a loan to a borrower with a weak credit history. A weak credit history is characterized by a history of late payments, bankruptcy, judgments, repossession, and/or foreclosure.

- A “nontraditional loan” is a mortgage loan that allows the borrower to defer repayment of the principal. Nontraditional mortgage products include such products as “interest-only” mortgages, where a borrower pays no loan principal for the first few years of the loan, and mortgage products that have balloon features at the maturity date.

- A “subprime MBS” is a nonagency MBS where the underlying pool of mortgage loans at the time of the origination of the security has a weighted average FICO score below 660 and/or where the underlying mortgage pools include subprime loans in an amount greater than one-third of the pool balance.

- A “nontraditional MBS” is a nonagency MBS where more than one-third of the underlying mortgage pool at the time of origination of the security consists of nontraditional loans.

Advances Collateral – Loans

The Bank accepts subprime loans and nontraditional loans that are underwritten in accordance with applicable regulatory guidance as eligible collateral for Bank advances. Any loans that meet the definition of a subprime and/or nontraditional loan in accordance with these guidelines and that were originated on or after July 10, 2007, must comply with the “Interagency Guidance on Nontraditional Mortgage Product Risks” and “Statement on Subprime Mortgage Lending” issued by the federal banking regulators on October 4, 2006, and July 10, 2007, respectively. If any such loan does not comply with this guidance as applicable, it is not eligible as collateral. In addition, the Bank does not accept as eligible collateral any mortgage loan that allows for negative amortization of the principal balance, including, but not limited to, pay-option ARM mortgage loans.

The Bank recognizes that these types of loans may present incremental credit risk to the Bank. Therefore, the Bank has monitoring and review procedures in place to measure the incremental risk presented by this collateral and to mitigate this incremental credit risk.

Advances Collateral – Mortgage-Backed Securities

The Bank does not accept Nontraditional MBS or Subprime MBS as collateral for advances. Any security acquired by the housing associate on or after July 10, 2007, that includes a loan or loans that meet the definition of a Subprime and/or Nontraditional Loan in accordance with these guidelines must comply with the “Interagency Guidance on Nontraditional Mortgage Product Risks” and “Statement on Subprime Mortgage Lending” issued by the federal banking regulators on October 4, 2006 and July 10, 2007, respectively. The housing associate must obtain an enforceable representation and warranty from the issuer of the security that all of the loans comply with the guidance noted. If the housing associate is unable to obtain such a representation and warranty from the issuer, then the security will not be eligible as collateral.

For all pledges of nonagency MBS collateral, housing associates must complete a pre-pledge checklist describing the security and the collateral backing the security. Based on this pre-pledge checklist and other analytical tools available to the Bank, including Bloomberg, rating agency subscriptions, and Intexnet, the Bank assesses the credit risk associated with the security based on the risk profile of the underlying loan collateral, structural or third-party credit enhancements to the security, and the collateral valuation discount applied. Based on this analysis of the security, the Bank may determine not to accept a security as collateral or to adjust the collateral valuation discount applied.

Appendix D – Advances Confirmations

The following advances confirmations can be downloaded in PDF format in Forms + Applications.

- Confirmation for Amendment and Restatement of Advance

- Confirmation for Amortizing Advances

- Confirmation for Callable SOFR-Indexed Floater Advances

- Confirmation for Community Development Member Option Advances

- Confirmation for Community Lending Advances

- Confirmation for Daily Cash Manager Advances

- Confirmation for Discount Note Floating Auction Rate Advances

- Confirmation for Fixed-Rate Advances

- Confirmation for HLB-Option Advances

- Confirmation for Member Option Advances

- Confirmation for Rollover Cash Manager Advances

- Confirmation for SOFR Flipper Advances

- Confirmation for SOFR-Indexed Advances

- Confirmation for Symmetrical Prepayment Advances

Appendix E – Borrowing Documentation

Housing Associates

All housing associates are required to execute the Agreement for Advances, Collateral Pledge, and Security Agreement for Nonmember Borrowers which establishes the Bank’s lien on all eligible assets to secure all extensions of credit.

As an alternative to executing our standard Advances Agreement, housing associates may execute an Agreement which establishes a specific lien on assets pledged to us to secure all advances made to the member by the Bank.

All housing associates must file an anti-predatory lending statement with the Bank as a requirement for borrowing.

Other Documentation

The Bank reserves the right to require, in its sole discretion, additional documentation, including, without limitation, agreements, resolutions, certifications, legal opinions, and applications, as a pre-condition to any housing associate obtaining an extension of credit from the Bank.

Release of Collateral

The Bank requires housing associates to pledge adequate eligible collateral to satisfy their Bank-approved collateral maintenance levels. From time to time, a housing associate that has listed or delivered collateral to the Bank, the Bank’s designee, or an approved third-party custodian may request the release of excess collateral (pledged collateral that exceeds the housing associate’s individual collateral maintenance level). Supporting releases are included in the Request to Release Pledged Loan Collateral, and the Request to Release Pledged Securities Collateral.

Bank Contacts

- Credit

- 800-357-3452, option 4

- credit@fhlbboston.com

- Collateral

- 800-357-3452, option 4

- collateral@fhlbboston.com

- Housing and Community Investment

- 800-357-3452, option 5

- housing@fhlbboston.com

- Member Funding Desk

- 800-357-3452. option 1

- memberfunding@fhlbboston.com