Balancing Liquidity and Interest-Rate Risks in a Fed Cutting Cycle

With short-term interest rates now moving lower, there are several advance solutions that can provide flexibility for members to manage constantly shifting liquidity needs and interest-rate risks.

A Pivot to Monetary Easing

The Federal Reserve chose to lower the target range for the federal funds rate by 50 basis points on September 18, a shift in monetary policy that came after a hiking cycle in which the timing and magnitude of rate increases took many by surprise. The rate hikes were followed by a lengthy pause at the top that was not expected by most market participants, as implied by the length and steepness of the inverted yield curve.

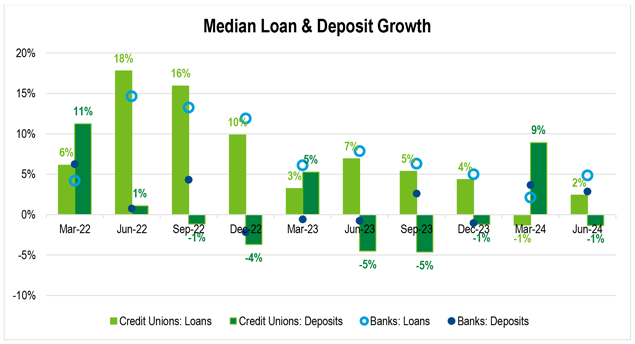

The path of interest rates has significantly affected both interest-rate risk exposures on balance sheets and liquidity risk metrics for depository institutions. The excess liquidity and increased asset sensitivity that was commonplace in 2020 and 2021 suddenly transitioned to stretched liquidity exposures and increased liability sensitivity. The chart below highlights the median loan and deposit growth experienced by FHLBank Boston depository members over the last two years. While growth has slowed recently, loan growth exceeded deposit growth, often by 10% or more, for several quarters.

As loan portfolios expanded and deposit growth did not keep pace, liquidity tightened. There was also significant migration within the deposit portfolio from core non-maturity deposits to higher-cost term deposits, which applied pressure from interest-rate risk and liquidity-risk perspectives. On the asset side of the balance sheet, average life extension in the mortgage and investment portfolios impacted asset sensitivity, and the unrealized losses and slowdown in prepayment speeds affected liquidity.

On the heels of a volatile period that has been challenging for balance sheet management, there are several advance funding solutions that can assist members in juggling the potentially uncertain need for interest-rate and liquidity-risk relief.

Looking ahead, many market observers are optimistic that lower short-term rates will provide some funding cost relief. The passage of time may allow for liquidity to normalize and low-yielding assets to be replaced at more favorable levels, even as short- and long-term rates have already come down by a fair amount. On the heels of a volatile period that has been challenging for balance sheet management, there are several advance funding solutions that can assist members in juggling the potentially uncertain need for interest-rate and liquidity-risk relief.

Interest-Rate Risk Mitigation Without Immediately Adding Funding

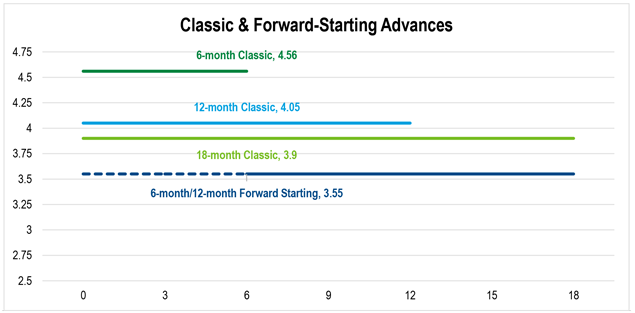

As noted in Strategies for a Pivot to Lower Rates at the start of 2024, members were able to capture the expected rate cuts that were built into the yield curve, which made extending funding a potentially attractive, and cost-effective, strategy. There are two advance solutions for members who may not need immediate incremental funding but would still like to benefit from what the yield curve has priced in.

The Forward Starting Advance allows members to price an advance using today’s yield curve, but delay the disbursement up to two years. In the example below, a member can initiate an advance today that disburses in six months, at which time it would have 12 months to maturity. Because of the inverted yield curve, the rate on this advance is below those of immediately disbursed six-, 12- and 18-month Classic Advances.

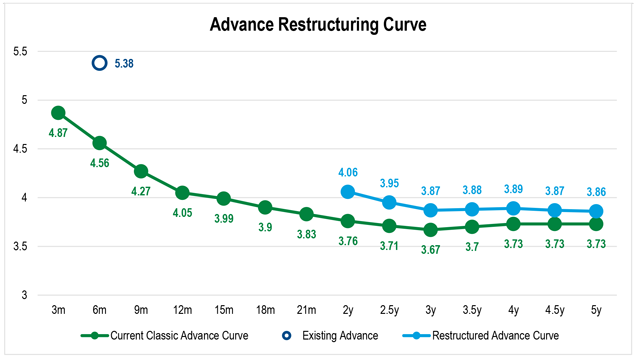

Advance restructures allow a member to take an existing advance and blend the implied prepayment fee across the maturity of a new advance. This can be valuable for a member who may have extended funding when rates were higher. A restructure allows them to take advantage of the inverted yield curve to add liability duration and reduce interest expense, all while not increasing borrowings or incurring a one-time hit to the income statement.

Adding Term Liquidity Now with Flexibility to Prepay Later

Forecasting liquidity needs can be challenging given how rapidly the environment shifted in 2020 and then again in 2022 and 2023. FHLBank Boston’s array of advance products enable members to add liquidity to meet their expected needs at various points on the yield curve. Outperformance in deposit gathering efforts, underperformance in loan growth, or an acceleration in prepayments and payoffs (whether market-rate driven or idiosyncratic) can reduce the need for funding.

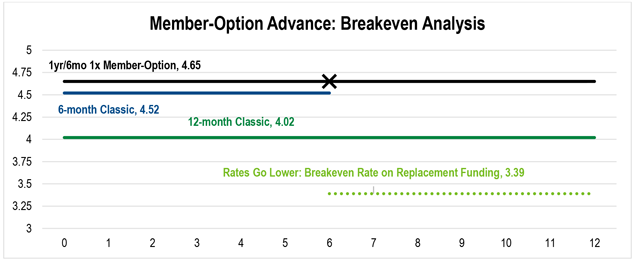

Advances like the Member-Option Advance and the Callable SOFR-Indexed Floater Advance can help tamp down that uncertainty by embedding member controlled flexibility to efficiently pay down the advance prior to maturity if the funding is no longer needed, while still offering the benefits of longer maturity along the way.

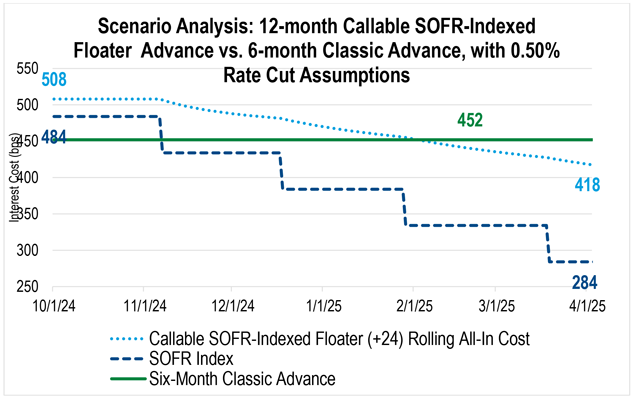

Consider a scenario where a member wanted funding for one year, but with the option to call the advance at the six-month mark. The Member-Option Advance could provide that funding at a fixed rate of 4.65%, and the Callable SOFR-Indexed Floater Advance offers a floating-rate alternative, priced at SOFR plus a spread of 24 basis points. The Callable SOFR-Indexed Floater Advance would have a day one rate of 5.08% but would adjust downward if, and when, further expected rate cuts materialize.

With the Member-Option Advance, we can assess the breakeven rates on a 12-month horizon compared to alternative strategies of funding with a 12-month Classic Advance for the full term, or funding with a six-month Classic Advance, and then utilizing replacement funding for the remaining six months. If rates fall, the breakeven is 3.39%, or 113 basis points below the current six-month Classic Advance. If six-month funding becomes available below 3.39% (whether with advances, or lower-cost deposits), then it would have been economically favorable to take the Member-Option Advance, exercise the option, and utilize replacement funding instead of funding with the 12-month Classic Advance at 4.02%.

The Callable SOFR-Indexed Floater Advance’s value in a declining rate environment is slightly different because the repricing occurs on its own as the coupon resets daily based on SOFR plus the fixed spread. If the Fed cuts rates at a faster clip (0.50% at every meeting) than the reductions currently priced in, the rolling cost of the Callable SOFR-Indexed Floater Advance is cheaper than the six-month Classic Advance at 4.52%. That cost savings is realized while still having the benefit of the extra six months of term liquidity due to the 12-month maturity. As with the Member-Option Advance, if the rate drop is accompanied by an uptick in lower-cost funding alternatives other than short-term advances – like from asset prepayments, deposits, or even terming out with advances – then exercising that option to realign the funding with future balance sheet needs would be possible.

Flexible Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact me at 617-292-9644 or andrew.paolillo@fhlbboston.com or reach out to your relationship manager for more details.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing.. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.