Funding Spread Lending Opportunities for Insurance Companies

As asset spreads become volatile and widen, insurance company members have several funding solutions to take advantage of spread lending opportunities. Whether the target assets are fixed-rate or floating-rate, with prepayable principal or in bullet structures, FHLBank Boston advances enable members to mitigate interest-rate risk and align asset and liability cash flows.

Is the Strength in Spreads Subsiding?

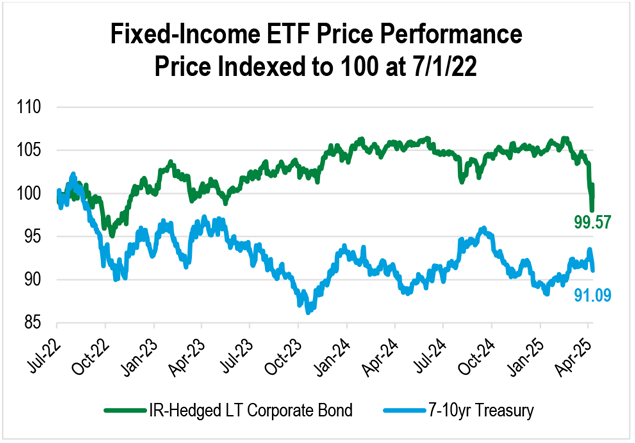

Predictably, when the Federal Reserve embarked on an interest-rate hiking cycle that took many by surprise due to the magnitude and swiftness of changes, prices on longer-term Treasurys suffered as yields moved higher. After some initial weakness that coincided with the first few rate hikes, investment-grade corporate bond spreads performed exceptionally well and tightened to near-record levels as the economy expanded. But now, as the Fed has pivoted to a rate-cutting regime, credit spreads have started to widen with noticeable weakness most recently attributable to tariff-related market uncertainty and volatility. As asset spreads move to wider levels and FHLBank Boston funding exhibits stability, this backdrop makes spread lending a more attractive proposition for insurance company members.

Mitigating Interest-Rate Risk

When establishing spread lending programs, many insurance companies select funding that mirrors the interest-rate risk profile of the asset(s) to capture favorable treatment from ratings agencies. With that strategy, the transaction is treated as operating leverage as opposed to financial leverage. Additionally, life insurance companies using funding agreements may seek transactions with cash-flow matching characteristics by funding fixed-rate assets with similar term fixed-rate funding or pairing floating-rate assets with floating funding. Members can utilize FHLBank Boston advances for this purpose by using Classic Advances for fixed-rate assets or SOFR-Indexed Advances for floating assets as the funding choice for an investment that shares the same maturity as the advance and has no optionality or amortization features. However, as the universe of investments that insurance companies consider expands from simple bullet structures, so does the lineup of advances that help meet the asset-liability management needs of members.

As the universe of investments that insurance companies consider expands from simple bullet structures, so does the lineup of advances that help meet the asset-liability management needs of members.

Fixed vs. Fixed with Flexibility

When asset spreads widen to levels where an adequate return can be achieved via match funding, the opportunity for spread lending is created. While at purchase the risk and return profile of credit assets may be at target levels, that can change over the life of the investment. The Member-Option Advance grants the ability to prepay the advance at predetermined intervals without being subject to a prepayment fee.

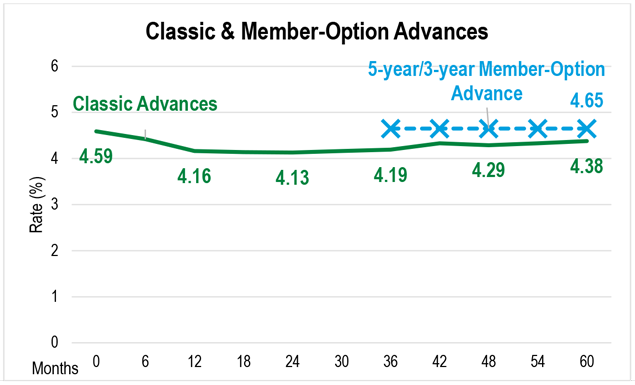

The chart above shows the long-term Classic Advance curve from one to five years and a five-year maturity, three-year lockout Member-Option Advance with semi-annual calls. With the Member-Option Advance, members can tailor the maturity, lockout period, and call frequency (one-time, semi-annual, or quarterly).

In this scenario, a member could add five-year bullet assets, fund it with the five-year/three-year Member-Option, and gain considerable flexibility in years three through five, when conditions may have shifted. Potential drivers of exercising the option might include:

- asset spreads tightening and the member wanting to sell the asset to take advantage of the narrower spreads,

- asset spreads widening and the member seeking to sell the asset due to not wanting to own the credit any longer,

- cash building up elsewhere on the balance sheet, allowing the ability to remove the leverage while retaining the asset,

- interest rates moving lower allowing a gain in the asset price to be realized, and

- interest rates moving lower allowing the ability to refinance the funding and increase the transaction’s spread.

Floating vs. Floating with Flexibility

Asset-backed securities (ABS) have been an area of growth for many insurance companies, as they can provide both diversification benefits and enhanced spreads. Many ABS are structured with floating-rate coupons, based on three-month term SOFR, and with prepayable principal, creating a profile where both the rate exposure and the amount of principal that needs to be funded is uncertain.

The Discount Note Auction-Floater Advance is a popular and effective way for members to match fund prepayable, floating-rate assets. Members can select the index to reprice at either four- or 13-week intervals (13-week is the most common for insurance companies, as that aligns with the frequency of three-month SOFR). Discount notes are the debt instruments FHLBank Boston issues to fund its balance sheet. Historically, discount notes have exhibited an extremely high correlation and a very small, sometimes negative, spread to T-bills and term SOFR. This structure allows for the alignment of the interest-rate risk profile between asset and liability.

With the floating-rate exposure covered, what about the uncertainty of the timing of the return of principal? The Discount Note Auction-Floater Advance allows the member to prepay the advance, in full or partially, at each coupon reset date, without being subject to a prepayment fee. This characteristic allows the member to efficiently recalibrate the amount of funding as the asset’s average life fluctuates due to actual prepayments and paydowns deviating from the expected average life at initiation.

| Feature | Description |

|---|---|

| Long-Term Liquidity | Maturity aligned with expected average life of the assets |

| Short-Term Rate Exposure | Funding reprices at the same frequency of the asset |

| Prepayment Flexibility | Pay down the advance with no fee as the asset balance declines |

Amortizing Assets

Investing in residential and commercial mortgages is another area of growth for the insurance sector. These types of assets, while typically fixed rate in nature, can often have uncertain cash flows, making “set it and forget it” funding solutions challenging to implement. The Amortizing Advance declines in balance according to a pre-determined schedule, aligning the cash flows according to the amortization period and balloon payment chosen.

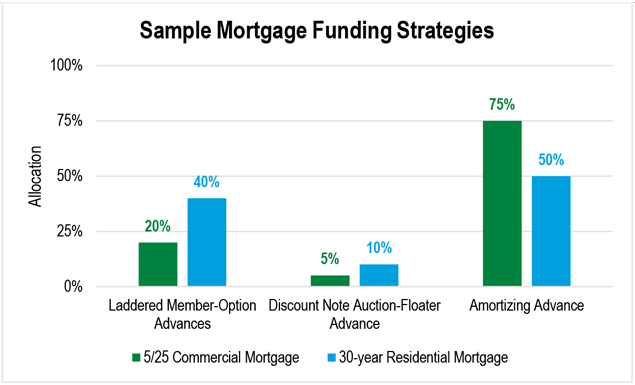

Consider the chart above which shows two approaches to funding residential and commercial mortgages utilizing the three advance solutions we have outlined thus far. Given prepayment risks tend to be less prevalent in commercial mortgages as opposed to residential, an insurance company member funding a commercial mortgage may seek to assign a high allocation to an Amortizing Advance (75% of the original amount), as the cash flows are likely to be more certain. The high level of customization offers a lot of options. If the mortgage was in a five-year balloon/25-year amortization structure, one could match the amortization exactly with the same terms or even elect to go slightly shorter on the funding, reducing the amortization term to 20 years.

With residential mortgages, one might rely less on the Amortizing Advance (50%) and incorporate more laddered Member-Option Advances and Discount Note Auction-Floater Advances to remain nimble to react to prepayments that present greater levels of contraction and extension risk. The paydown of the Amortizing Advance, supplemented with the member-controlled optionality in the other two advances, allows the member to dynamically adapt as the asset pays down and the future cash flow profile evolves.

Reliable Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact me at 617-292-9644 or andrew.paolillo@fhlbboston.com or reach out to your relationship manager for more details.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.