Strategies for a Pivot to Lower Rates

Amid signals that the interest-rate cycle may shift, certain funding solutions can present value in managing liquidity, earnings, and interest-rate risk.

The End of Quantitative Tightening?

The rise in both short- and long-term interest rates that began in early 2022 was noteworthy for both the magnitude of the move and the swiftness with which it occurred. In just under 2 1/2 years, the Federal Funds Target Range increased by 525 basis points, and intermediate and long Treasury yields rose accordingly by 300 to 500 basis points, reflecting the shift in economic conditions and outlook. But as 2023 wrapped up, the market appeared to be bracing for a pivot away from the aggressive hiking cycle and preparing for the possibility of the start of a rate-cutting cycle.

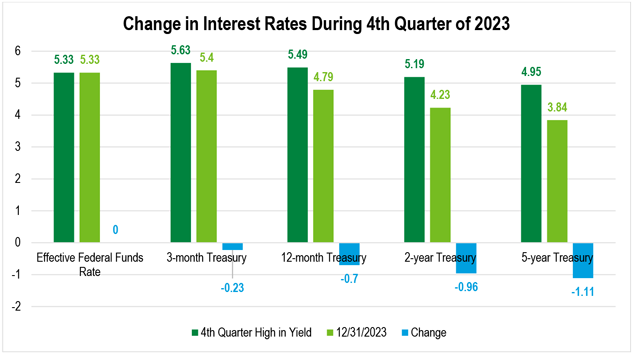

As the chart above shows, interest rates rallied hard to end the year, with levels on Treasury securities on December 31 markedly lower than the peaks they hit during the middle of the quarter. Fueling this move was commentary and signaling from Federal Reserve officials that they have shifted discussion internally to when it might be prudent to move towards a more accommodating policy stance. As is often the case, longer maturities on the yield curve moved first and by a greater magnitude than the shorter end of the curve. For example, the five-year Treasury fell by more than 100 basis points off its peak, whereas the three-month Treasury moved down by “only” 23 basis points.

So, on the cusp of a potential shift from a quantitative tightening to a quantitative easing environment, how should depository institutions approach decisions related to funding? Complicating matters is the aforementioned magnitude and swiftness of the move-in rates over the last year, which have created many new dynamics regarding interest-rate and liquidity-risk management, as well as the earnings profile for many institutions. Additionally, Fed officials hinting at potential cuts by no means guarantees that rates will go down soon and sharply. In fact, in the first few weeks of the year, the market expectations for rate cuts in 2024 have softened and reversed some of the aggressive positioning that occurred in late 2023.

Taking Advantage of an Inverted Yield Curve

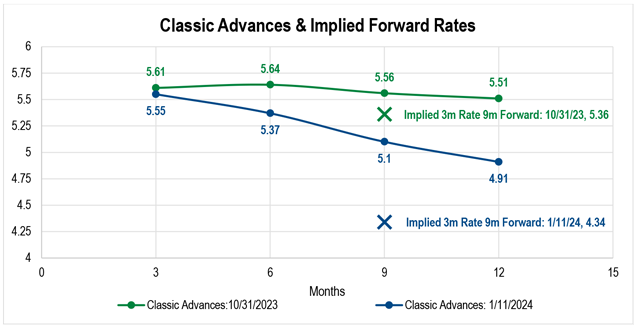

It may seem intuitive that if market rates are expected to decline, then shortening the duration of your funding makes sense. This would potentially allow members to replace the funding at lower rates in the future. While this can often be the case, it’s important to remember that current market expectations are priced into the level and the shape of the yield curve. The end-of-year rally pushed the spread between three-month Classic Advances and 12-month Classic Advances from -10 basis points at the end of October to over -60 basis points as of January 11. That level of yield curve inversion implies a market expectation that short-term rates in the future may be lower than where they are presently.

Consider the chart below, highlighting that when the yield curve exhibits a greater degree of inversion, the implied rate on the three-month Classic Advance nine months forward is much lower than the current three-month Classic Advance. At the end of October, when the yield curve was flatter, the implied forward rate was just 25 basis points below the current rate. With a more inverted yield curve in mid-January, that rate differential had moved wider to nearly 125 basis points.

Depending on specific balance sheet needs, incrementally extending maturities can still capture the expected future repricing of short-term rates while providing interest expense savings in the current period and mitigating interest-rate risk if rates do not drop according to the timing or the amount currently being priced in.

Bolster Liquidity While Keeping Duration Short

Many depository institutions continue to be stressed on liquidity risk metrics, especially on the asset side of the balance sheet where much of the bond portfolio is likely still significantly underwater, and a meaningful acceleration of loan and investment prepayments that would produce cash flow and return principal would require a further steep drop in intermediate and long-term interest rates.

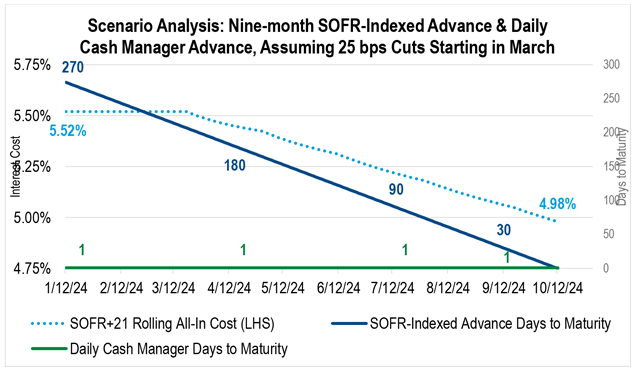

Floating-rate advances like the SOFR-Indexed Advance provide members with funding that reprices every single day – much like the Daily Cash Manager Advance does – and would produce decreasing interest expense costs if short-term rates drop faster and by more than consensus. Floating-rate advances can produce additional benefits by reducing operational burden compared to continually rolling overnight advances and by being more favorable to liquidity metrics because of the longer final maturity of the funding.

The scenario analysis below shows the total interest cost for a nine-month SOFR-Indexed Advance, assuming 25 basis point cuts commencing in March and continuing at every Fed meeting thereafter until maturity. At a spread of +21, the day one rate on the advance would be 5.52%, which is equal to where the Daily Cash Manager Advance was priced on that same day. As SOFR moves lower, so would the all-in cost of both the SOFR-Indexed Advance and the Daily Cash Manager Advance. However, the floating-rate advance provides greater liquidity along the way through a substantial edge in days to maturity. Additionally, the Daily Cash Manager Advance could be subject to spread widening as it reprices daily as opposed to the SOFR-Indexed Advance, where the spread component is fixed for the life of the advance.

Margin Relief

Since mid-2022 when the yield curve became inverted and interest-rate volatility shot higher, the HLB-Option Advance has been a popular and effective funding solution for many members. Typically, the optimal rate environment for putable advances like this is when interest rates remain relatively unchanged. But at present, the growing differential between HLB-Option Advance rates and the incremental bullet alternative provides members ample cushion to absorb a move lower in market rates and still keep all-in funding costs low.

| Structure | Rate | Term | Rate | Spread |

|---|---|---|---|---|

| 2-yr/3-mo | 4.03% | 3-month | 5.52% | -149 bps |

| 5-yr/1-yr | 3.42% | 1-year | 4.76% | -134 bps |

| 10-yr/1-yr | 2.96% | 3-month | 5.52% | -256 bps |

The table above shows a sampling of HLB-Option Advance structures, as well as the spread compared to the Classic Advance term and rate that matches the lockout period of the HLB-Option Advance. The high level of customization affords members flexibility to align the structure with their balance sheet needs and preferences. For example, members inclined to minimize tail risk may find appeal in the two-year maturity, three-month lockout at 4.03%, while members looking to reduce funding costs further could gravitate towards the 10-year maturity, three-month lockout at 2.96%.

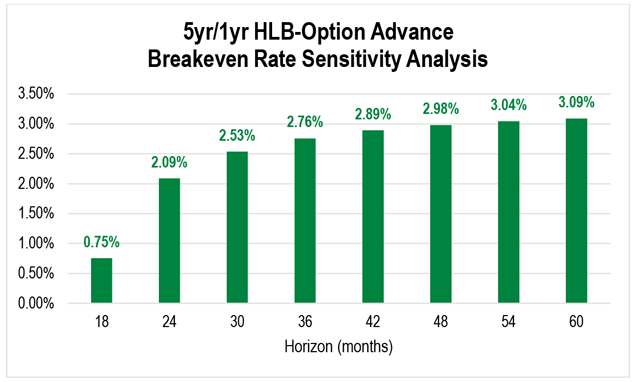

Since the HLB-Option Advance offers immediate cost savings compared to the short-term bullet alternative, we can conduct a breakeven analysis to see how far and how soon rates would have to fall for the HLB-Option Advance to underperform a strategy of using a Classic Advance and then replacing the funding.

For example, let’s use the five-year maturity, one-year lockout alternative at 3.42%. Compared to the one-year Classic Advance at 4.76%, the HLB-Option Advance saves 134 basis points in year one. The chart below shows the breakeven rate needed on replacement funding for the total funding cost to equal the 3.42% cost for the HLB-Option Advance for a given horizon. The shorter the horizon, the lower the rate on replacement funding (wholesale or deposit) would need to be to outperform the HLB-Option Advance on total cost. For balance sheet managers positioning for a “soft landing” where any drop in rates may be more modest in scale, structures like these can be of significant value in providing margin support when it is sorely needed.

Flexible Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact me at 617-292-9644 or andrew.paolillo@fhlbboston.com or reach out to your relationship manager for more details.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing.. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.