Advance Restructuring Strategies to Enhance Earnings

Restructuring advances can improve earnings and interest-rate risk profiles without adding incremental funding.

Weren’t Rates Supposed to be Lower by Now?

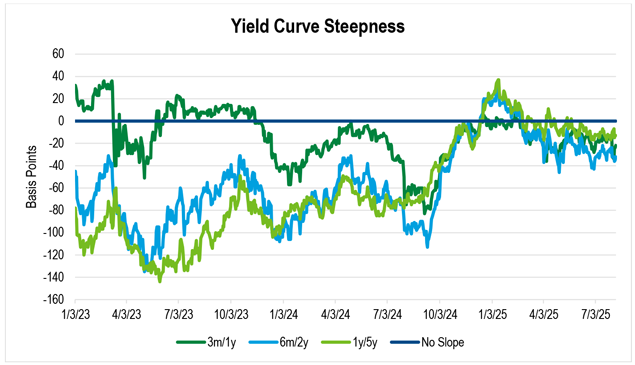

The shape and level of the yield curve play a big role in a depository institution’s decision making and performance. The inversion of the yield curve creates challenges, as liabilities priced off the shorter end of the curve become relatively more expensive compared to assets driven by longer tenors. When the yield curve remains inverted, like it has for the last two years, the operating environment becomes particularly difficult.

The last interest rate hike in the most recent cycle occurred in July 2023. Even as the Federal Reserve increased short-term rates into the mid 5% range, bond investors were forecasting a quick pivot to an aggressive cutting cycle, as implied by intermediate tenor Treasury rates priced at much lower yields. However, the anticipated rate cutting didn’t materialize. A practical takeaway from this example is to recognize that the market’s ability to “predict” the direction, timing, and magnitude of interest rate moves is far from infallible, and a prudent approach for many is to be prepared to take advantage of market movement and volatility to meet balance sheet needs.

Advance Restructures

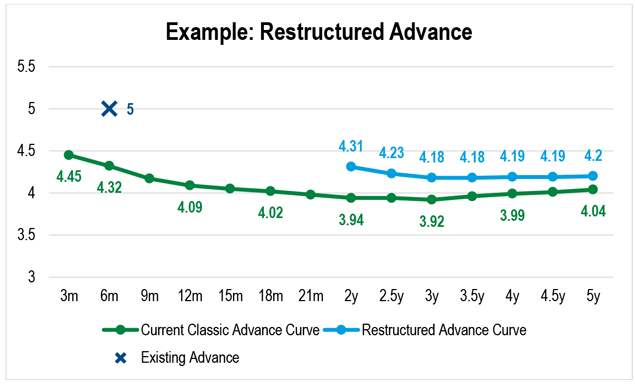

For members that have grown reliant on wholesale funding, as loan growth has been solid and cost-effective deposit gathering efforts have been challenging, advance restructures offer a solution to mitigate margin pressure caused by higher interest rates. Advance restructures afford members the ability to modify the coupon and maturity of an existing advance to mitigate interest-rate risk and lower interest expense. Often referred to as “blend and extend,” advance restructures do not include the prepayment fee that would typically be present if a member prepaid an advance because rates fell. With an advance restructure, the prepayment fee is annuitized and blended into the coupon of the new advance, which carries a longer maturity. The member can immediately lower the rate they are paying and benefit from an extended maturity that creates a stronger interest-rate and liquidity risk profile. Additionally, the restructuring does not incur any one-time impact to the current period’s income statement.

Advance restructures afford members the ability to modify the coupon and maturity of an existing advance to mitigate interest-rate risk and lower interest expense.

Let’s consider the following example: A member has an existing advance with a 5% coupon and six months left until it matures. The advance coupon is comfortably above the entire advance curve. An advance restructure would allow the member to take advantage of current rates without taking out incremental funding. The prepayment fee of approximately 0.75% is blended into the new advance. If the member restructures into a three-year advance, the new coupon would be 4.18%, 82 basis points below the existing advance rate.

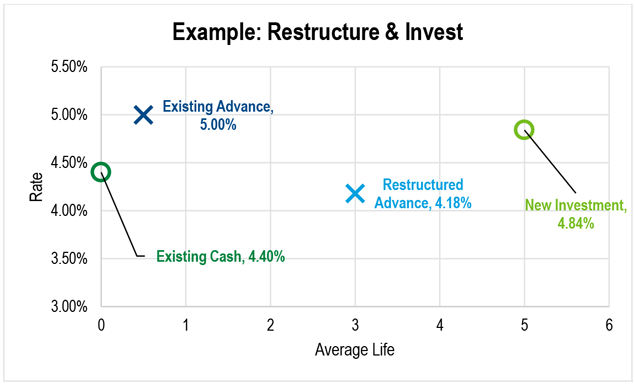

Restructure & Invest: Creating Capacity to Take Asset Duration

A balance sheet-driven approach to utilizing an advance restructure would be to use the extension of the funding to dampen the interest-rate risk impact of adding unhedged fixed-rate assets. Let’s revisit the example above to have the member simultaneously purchase an investment with a five-year average life and priced at a yield spread of +100 vs. Treasurys, or 4.84%. Before the transaction, the member earned 4.40% on excess cash through Interest on Reserve Balances and paid 5% on the advance. Post transaction, there is a yield pickup on the asset side, as well as a drop in cost for the liabilities.

Additionally, the advance maturity extension from six months to three years mitigates the replacement of an overnight asset with a five-year asset. The net result is effectively adding two years of average life but at a spread of +182 – the +100 from the asset and +82 from the restructure. The graph below highlights how the asset profile shifts up and to the right (longer average life and higher yield) while the liability profile shifts down and to the right (longer average life and lower rate paid).

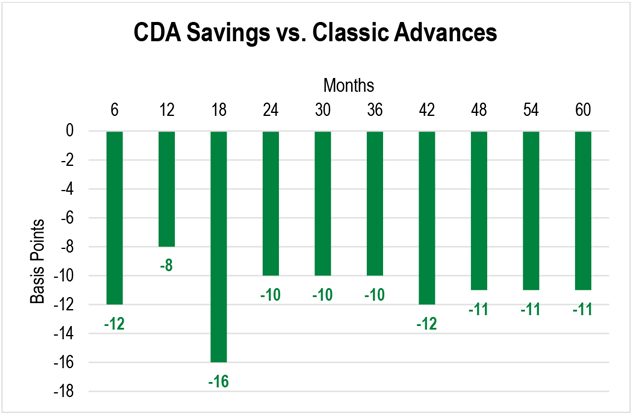

Enhancing Savings with the Community Development Advance

To further save on interest expense, members can consider the Community Development Advance (CDA), one of the discounted advance programs that fulfills FHLBank Boston’s mission of supporting housing and economic development across New England. As shown in the chart below, CDAs offer cost savings when compared to Classic Advances. If a member restructures an advance into a new CDA as opposed to a new Classic Advance, the cost savings flow directly to the bottom line. For example, if 70 basis points of savings were achievable with a Classic Advance restructure, then a CDA restructure to the three-year mark would produce 80 basis points of savings.

Forward Starting Advances

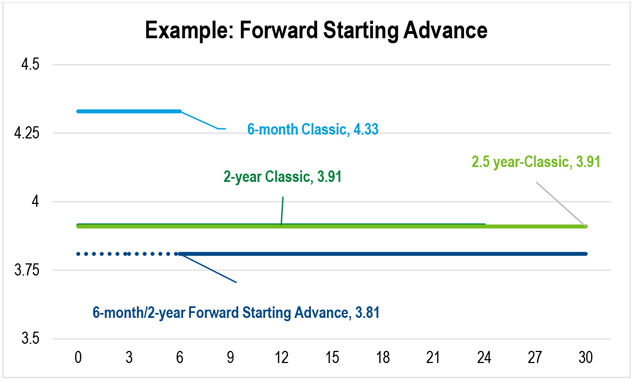

If a member does not have an existing advance with the combination of coupon and time to maturity that would make a restructure an option, there is a way to benefit from the shape and level of today’s yield curve without adding incremental funding immediately. Forward Starting Advances allow members to lock in a rate based on today’s yield curve but delay the funds’ disbursement for up to two years. An inverted yield curve creates a situation where forward rates are below spot rates, given the expectation that rates may be lower in the future. If the magnitude and timing of future rate cuts do not materialize to the extent that the yield curve is pricing in now, then Forward Starting Advances can disburse at favorable rates at an advantageous time.

Reliable Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact me at 617-292-9644 or andrew.paolillo@fhlbboston.com or reach out to your relationship manager for more details.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the views of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.