Are Asset Quality Issues Out Front or in the Rearview?

As the Federal Reserve has pivoted to rate cuts, there has been some deterioration in asset quality. But will healthy loan-loss reserves at banks and credit unions be sufficient to absorb the issues or are earnings at risk?

Fed Funds Policy Lag

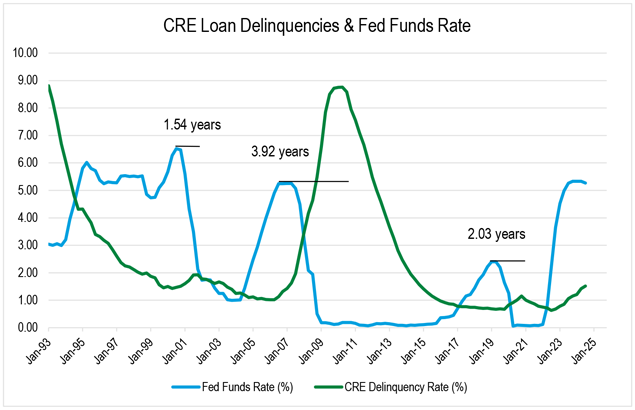

Over the last three economic cycles beginning in the early 2000s, the lag between peak short-term interest rates and delinquencies on commercial real estate (CRE) loans for FHLBank Boston member banks has ranged from 1.5 to four years. If this cycle follows the trend, commercial loan delinquencies may continue rising and peak in 2025 or 2026.

In the early 2000s, the pace of the hiking cycle and pause at the top were brief, and so was the rise in delinquencies. During the 2008-2009 cycle, the Federal Reserve (the Fed) paused at the top for 446 days, and the ensuing asset quality weakness caused a financial crisis. The current cycle’s top spanned 419 days, nearly equal to the 2008-09 cycle the Fed paused from July 26, 2023, until October 18, 2024, spanning a total of 419 days.

If the Fed is forced to take a slower approach to cutting rates than currently forecasted, it may suggest economic strength and asset quality resilience (i.e., a soft landing). If the Fed cuts rates more aggressively, it may suggest labor market and broader economic difficulty that could lead to further deterioration of credit quality metrics (i.e., a hard landing).

Where is the Trouble Concentrated?

Since the Fed began cutting interest rates, there has been much talk of a hard versus soft economic landing. If the Fed is forced to take a slower approach to cutting rates than currently forecasted, it may suggest economic strength and asset quality resilience (i.e., a soft landing). If the Fed cuts rates more aggressively, it may suggest labor market and broader economic difficulty that could lead to further deterioration of credit quality metrics (i.e., a hard landing).

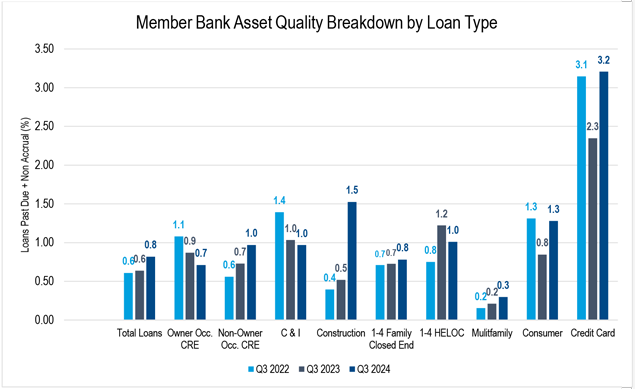

While overall delinquencies are up, the timing and severity of the changes in asset quality for member banks vary greatly between loan categories. Owner-occupied CRE and commercial and industrial loans are improving, while non-owner-occupied CRE is deteriorating. Construction lending has seen a rapid uptick in issues recently, while past-due residential and multifamily loans have ticked up only slightly and remain low.

Credit Union Asset Quality

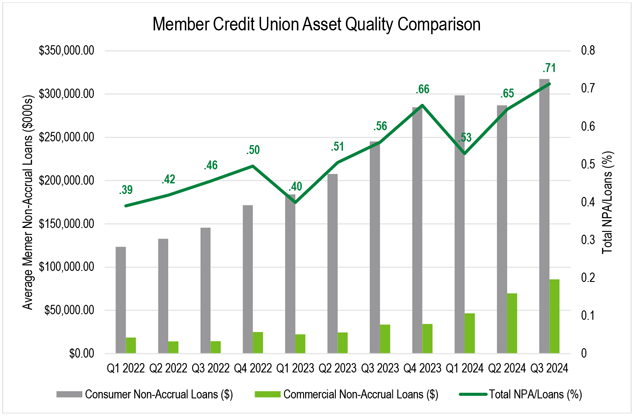

The chart below shows total non-accrual loans broken down by consumer and commercial loans across all FHLBank Boston member credit unions. Notable is the variance in the timing and velocity of the increases in non-accrual loans.

For instance, total non-accrual consumer loans increased steadily between the first quarter of 2022 and the first quarter of 2024 before leveling off over the past two quarters. Commercial non-accrual loans were low during 2022 and 2023 before rising at the start of 2024. As of the third quarter of 2024, commercial loans only made up 6.92% of member credit union loans but comprised 21.2% of member credit union non-accrual loans.

What is the Distribution of Asset Quality Challenges?

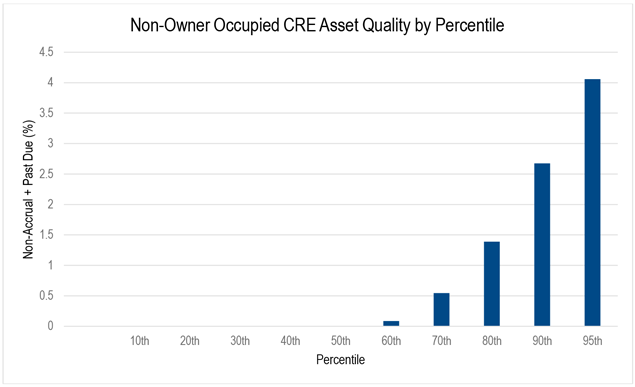

Potential issues for the CRE sector have been well documented, but the data shows that credit weakening in this sector is not particularly broad-based right now. The chart below shows the percentage of past due and non-accrual loans as of the third quarter of this year, broken out by percentiles. Interestingly, half of member banks have no past due and non-accrual loans in non-owner occupied CRE, and most of the softening has been within just a small segment of institutions.

In New England, rural areas have generally fared better than urban areas when it comes to asset quality. Total non-performing assets were 0.73% for Greater Boston area member banks as compared to 0.19% for New Hampshire member banks as of the third quarter of this year.

Reserve Levels Mostly Solid

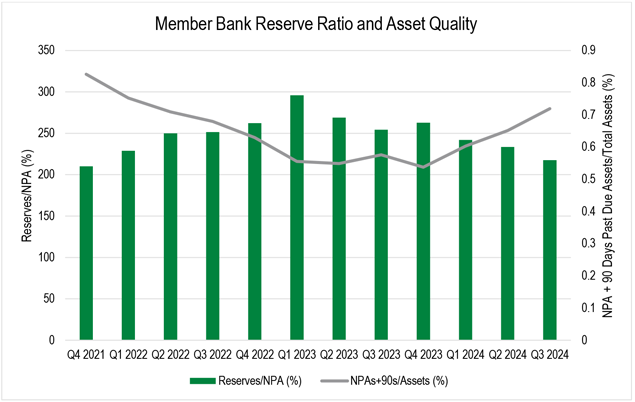

With the issues in asset quality accelerating for some members, will a healthy loan-loss-reserve cushion be enough to protect earnings? The chart below shows the relationship between the loan-loss reserve and asset quality for member banks.

Coming out of the pandemic, banks prepared themselves for the potential of heightened credit losses and set aside larger loan-loss reserves. As asset quality improved, loan-loss reserves jumped from just over 200% to roughly 300% of non-performing assets (NPAs).

The chart below highlights how banks only started bringing down their reserves in early 2023 after bolstering them as a buffer against the potential COVID-related asset deterioration. As NPAs ticked back up, the reserve ratio has come down, and while the ratio remains within a healthy range, this trend is something to monitor.

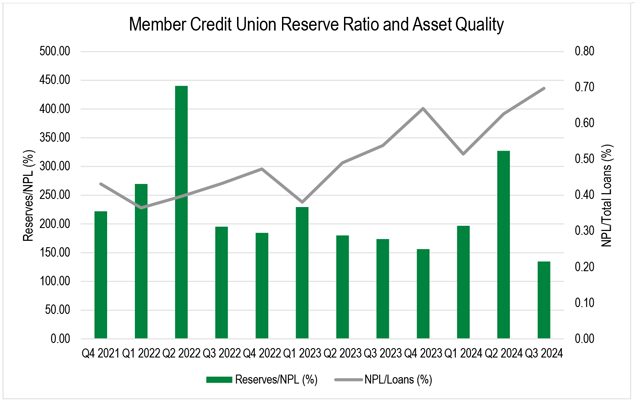

On the other hand, credit unions increased their reserves faster and to a higher level than member banks coming out of COVID, but they also brought them down much quicker. While non-performing loans (NPLs) rose steadily over the past two years, loan loss reserves as a percentage of NPLs have not increased. Reserves still sit above 100% of NPLs, but asset quality is deteriorating — a trend to watch.

Tools for an Uncertain Credit Environment

FHLBank Boston offers members options that can help navigate a soft or hard economic landing:

- If interest rates don’t drop lower than what is currently priced in, a targeted amount of extension in wholesale funding could be beneficial. Advances like the Amortizing Advance can help to mitigate long-term interest-rate risk, capture spread with a re-steepened yield curve, and organically reduce wholesale funding reliance as assets pay down.

- If the Fed cuts interest rates faster and credit softens, the SOFR-Indexed Advance or Discount Note Auction-Floater Advance could help lock in long-term liquidity while realizing the benefit of rate cuts with short-term interest-rate exposure.

- To help reduce interest-rate, liquidity and credit risk, and boost non-interest income, members can sell mortgages through FHLBank Boston’s Mortgage Partnership Finance® (MPF®) Program.

Flexible Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact me at tyler.buckeridge@fhlbboston.com, or your relationship manager for more details.

*Mortgage Partnership Finance and MPF are registered trademarks of the Federal Home Loan Bank of Chicago.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing.. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.