Dividends Lower Effective Borrowing Costs

In an environment with higher interest rates than have been observed in almost a generation, FHLBank Boston dividends are an important consideration when evaluating funding options and prices. Dividends reduce effective borrowing costs and unlike other alternative funding providers, there are no other basis point fees that would increase the net borrowing cost. Ignoring these subtleties could be costly to your institution.

Highlights and Key Points

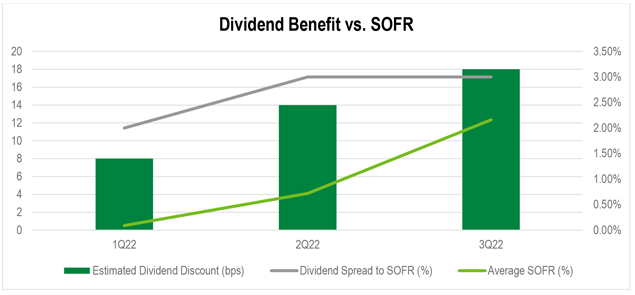

Historically over the first three quarters of 2022, dividends on capital stock resulted in an estimated effective discount of approximately eight to 18 basis points on term advances and about six to 12 basis points on overnight advances, largely depending on when the advance is taken in the quarter relative to how much interest rates change during the quarter. Below are some reminders about FHLBank Boston’s stock and dividends:

- Capital stock requirements exist to allow FHLBank Boston to meet its mission of providing reliable funding to members in all market environments.

- The Activity-Based Stock Investment Requirement (ABSIR), in particular, allows FHLBank Boston to shrink or grow its balance sheet rapidly as economic conditions and member demand for advances warrant.

- The effective estimated value of the dividend discount is not static and will depend on a variety of factors, including, but not limited to, absolute interest rates, the pace of interest rate changes, accrual conventions, and FHLBank Boston policies.

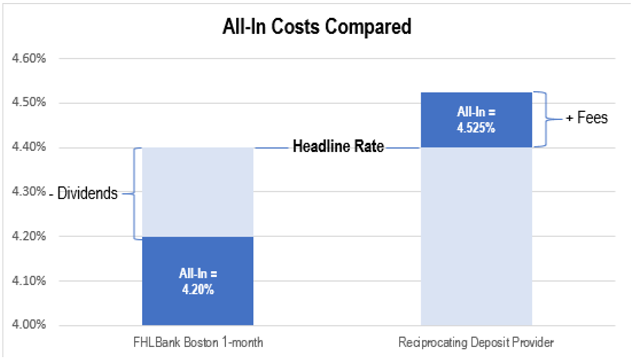

Unlike alternative funding providers that often charge fees in basis points that increase the all-in cost of borrowings, FHLBank Boston’s dividends essentially reduce the all-in cost of advances.

A Self-Capitalizing Cooperative

At any given time, the stock requirement of an FHLBank Boston member is determined as the sum of its Membership Stock Investment Requirement (MSIR) and ABSIR.

Per FHLBank Boston’s present Capital Plan, MSIR is calculated as 0.05% of the membership stock investment base, defined as the member’s total assets (or total net admitted assets, excluding separate accounts, for insurance company members) at the prior year-end. MSIR is a minimum of $10,000 and a maximum of $5 million.

The ABSIR varies based on the activity. For overnight advances, such as the Daily Cash Manager Advance, the requirement is 3.00% of the principal balance. For all advances with terms of two days or more, the requirement increases to 4.00%. Letters of Credit have a requirement of 0.25% of the notional amount.

These ABSIR requirements allow FHLBank Boston to operate prudently while preserving maximum balance sheet flexibility. If demand for advances increases, members’ required stock purchases allow FHLBank Boston’s balance sheet to expand and absorb the change in its assets.

Evidencing this fact in the first three quarters of 2022, advances outstanding have increased 172.8%, and the overall balance sheet has increased 80.9%. FHLBank Boston’s self-capitalizing model allows it to provide reliable funding against quality collateral and ensure safety and soundness is maintained.

Dividends reduce effective borrowing costs, and unlike other alternative funding providers, there are no other basis point fees which would increase the net borrowing cost. Ignoring these subtleties could be costly to your institution.

Dividends Lower Effective Borrowing Costs

While dividends are not guaranteed and, prior to any entitlement, are subject to approval each quarter by FHLBank Boston’s board of directors, the second and third quarters of 2022 have seen dividend declarations equivalent to the average of SOFR for the quarter plus 300 basis points. In the third quarter, this equaled a rate of 5.16%.

Because stock requirements are tied to borrowing activity, dividends translate into lower effective borrowing costs.

Putting Numbers Around the Value of the Dividend Relative to Advance Rates

Estimating the value of that implied dividend-related discount is more nuanced than may be immediately evident.

First, advance costs are calculated on a 360-day accrual basis, and dividends are paid on a 365-day accrual basis. Second, because interest rates have been increasing so quickly, the average SOFR for the overall quarter has been printing higher than nominal SOFR levels observed early in the quarter and lower than nominal SOFR levels observed late in the quarter. Because borrowing costs are closely correlated with SOFR, the effective discount value of the dividend may be mismatched across different advance terms depending on whether the advance crosses a quarter-end and/or another rate hike.

These effects and the relative value of the dividend are estimated in a couple of hypothetical scenarios below based on the third-quarter 2022 dividend rates.

| 2-Week Advance | 2-Week Stock Amount | |

|---|---|---|

| Assumed Advance/Dividend Rate | $10,000,000 | $400,000 |

| Duration | 2.71% advance rate | 5.16% dividend rate |

| Accrual | 360 | 365 |

| Interest/Dividend | $10,538.89 (interest) | $791.67 (dividend) |

Subtracting the value of the dividend from the cost of interest equals $9,747.22. Dividing this dollar value by 14 (the number of days the advance is outstanding), multiplying by 365 days/year, and then dividing this result by the size of the advance ($10,000,000) results in an effective all-in rate of 2.541%. With a headline advance rate of 2.71%, the effective dividend-related discount is 16.9 basis points.

| 2-Week Advance | 2-Week Stock Amount | |

|---|---|---|

| Amount | $10,000,000 | $400,000 |

| Assumed Advance/Dividend Rate | 1.56% advance rate | 5.16% dividend rate |

| Accrual | 360 | 365 |

| Interest/Dividend | $6,066.67 (interest) | $791.67 (dividend) |

Following the same logic, subtracting the value of the dividend from the cost of interest equals $5,275.00. Dividing this dollar value by 14 (the number of days the advance is outstanding), multiplying by 365 days/year, and then dividing this result by the size of the advance ($10,000,000) results in an effective all-in rate of 1.375%. With a headline advance rate of 1.56%, the effective dividend-related discount is 18.5 basis points.

Because interest rates rose significantly in the third quarter, the effective value of the dividend-related discount was higher earlier in the quarter. This circumstance arises from the fact that dividends are paid on the average amount of stock held over the quarter.

Moreover, the dividend-related discount has increased not only because interest rates have risen but also because the FHLBank Boston dividend spread to SOFR increased. Indeed, the dividend spread in the second and third quarters of 2022 was also raised relative to the first quarter.

Don’t Forget FHLBank Boston Dividends and Alternative Funding Providers’ Fees

While dividends at FHLBank Boston benefit borrowers by effectively lowering their all-in funding costs, alternative sources of funding generally add fees in basis points to nominal borrowing costs. When evaluating different funding sources, it can be easy to overlook this important circumstance.

All else equal, assuming a 20-basis points effective value of dividends and a 12.5-basis points fee at an alternative funding provider, FHLBank Boston’s all-in pricing may be approximately 32.5 basis points better than other sources of wholesale funding under particular circumstances. At that level, a member could benefit from $162,500 and $325,000 in net savings on borrowings of $50 million and $100 million, respectively.

When borrowing needs arise, members that factor the value of dividends into their calculations will be positioned to outperform by optimizing funding costs.

Flexible Funding Solutions

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact Andrew Paolillo at 617-292-9644 or andrew.paolillo@fhlbboston.com or reach out to your relationship manager for more details.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing.. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.