Funding Strategies for Volatile Markets

Shifting expectations on the Federal Reserve’s path have changed the level and shape of the curve, creating liquidity needs but also opportunities for members.

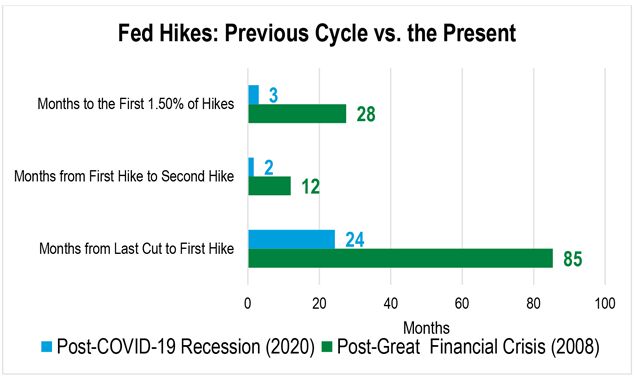

Rates Are Moving Much Faster This Time Around

As the Federal Reserve began raising overnight interest rates in 2022, many market participants recalled the experiences coming out of the Great Recession when the Fed was slow and deliberate with rate hikes. But this cycle is unique for many different reasons and what we are seeing at present is a wildly different approach with the timing and magnitude of rate hikes on a much faster/greater scale. As the chart below shows, the timeline for rate hikes now is significantly accelerated compared to the response that followed the 2008 financial crisis.

This big change in outlook has had wide-ranging implications on the yield curve as well as the rates and spreads of the instruments that our members put on both sides of the balance sheet. The intermediate part of the yield curve has risen to adapt to the prospect of fast approaching higher short-term rates, while the long end has grappled with making sense of persistently high inflation readings balanced by some flight to quality as signs of a potentially slowing economy emerge. Spreads on mortgage and credit-related instruments have pushed wider as the Fed switches from an easing to a tightening stance.

Also, as one might anticipate when expectations change quickly and sharply, interest-rate volatility has gone up considerably. To put that into context, some measures of interest-rate volatility at present are exceeding what was seen at the height of market and economic uncertainty in March 2020.

This historic volatility and changing interest-rate landscape has created opportunities for our members on the asset side and on the funding side that are different in scope than what was relevant and attractive just a few months ago. Below are some examples of strategies that we have seen renewed interest in, and activity, of late.

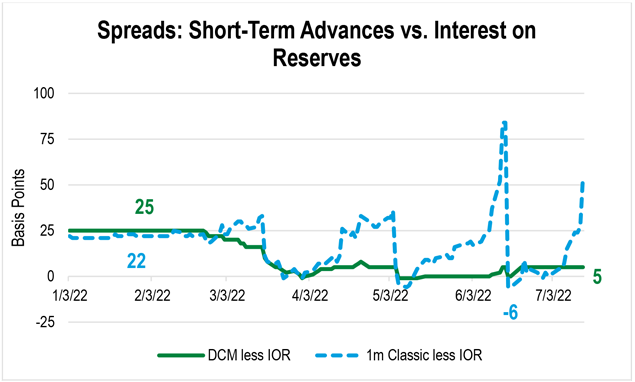

Narrow Spreads at the Front-End of the Curve

At the beginning of 2022 before rate hikes began, there was about a 25-basis point differential between Daily Cash Manager Advance (DCM) and one-month Classic Advance rates as compared to the yield on Interest on Reserves (IOR) depositories can receive on cash held at the Fed. But as rates moved higher and became more volatile, those spreads compressed. The DCM has recently been pricing closer to only 5 basis points above IOR. Additionally, Classic Advances with terms between one week and one month have been priced below IOR, typically at times before term rates begin to price in the next expected hike in overnight rates.

Stalling deposit growth, strong lending pipelines, and liquidity metrics stressed from unrealized losses on investments have all contributed to a widely different operating environment from what many experienced for most of the last two years.

This dynamic affords members great flexibility in managing short-term liquidity levels: if the borrowing rate for advances (even before factoring in the benefits of the dividend) is at or below the rate you receive to hold cash, then one can inventory the liquidity without incurring the negative carry typically associated with that action.

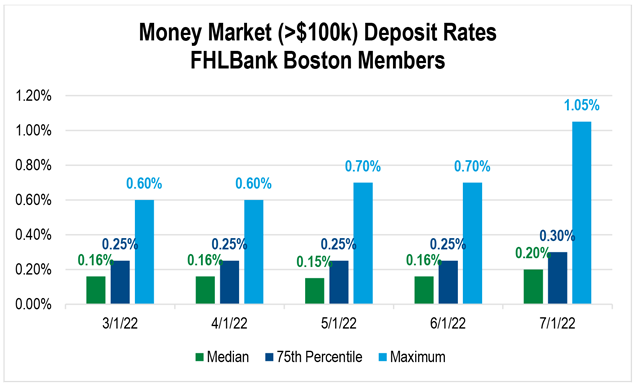

Using Advances to Price Deposits Efficiently

The cheapening of short-term advances comes at a much-needed time for depositories as liquidity conditions appear to be aggressively changing. Stalling deposit growth (in some cases net outflows), strong lending pipelines, and liquidity metrics stressed from unrealized losses on investments have all contributed to a widely different operating environment from what many experienced for most of the last two years.

While many have thus far lagged the rise in short-term rates, we are observing deposit rates beginning to rise — the first movers are beginning to offer higher rates. This puts into focus the challenge of efficiently pricing and valuing deposits versus using wholesale funding.

In a recent two-part case study (Part 1, Part 2), we dove into analyzing the deposit portfolio and understanding the factors that drive balance sheet profitability. We shared examples from our Deposit Pricing Analysis tool, which can be used to run scenario and sensitivity analysis to assess the impact from cannibalization within the portfolio when adjusting rates.

In many instances, a migration of just a small amount (3%-5%) parked in an existing savings or money market deposit account to a high-cost deposit special may be sub-optimal from a profitability perspective compared to utilizing just-in-time liquidity from advances. To learn more about this Deposit Pricing Analysis tool, contact your relationship manager.

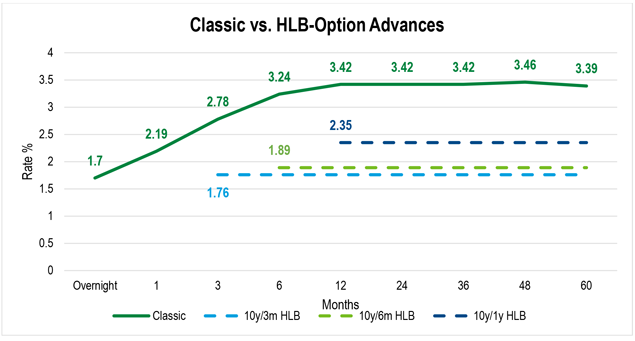

HLB-Option Advance

The rise in interest-rate volatility has created relative value in products like the HLB-Option Advance which enables a member to receive a lower rate on the funding by granting the right to FHLBank Boston to put back the advance after a designated lockout period.

One way to think about the HLB-Option Advance is in comparison to the structure of a retail Certificate of Deposit (CD) where the customer might ask the depository for a long final maturity (say 10 years) but want to retain the flexibility to give back the funding every quarter without paying a prepayment fee. In this instance, the depository would likely price the CD below the “regular” CD rates to compensate for the fact the customer can decide to keep or give back the funding. When interest-rate volatility is high like it is now, that option is worth more, which translates to a lower price/steeper discount for these types of structures compared to bullet alternatives.

Consider the chart below comparing recent pricing on several HLB-Option Advance structures and the Classic Advance curve. As you can see, the available rate on HLB-Option Advances is comfortably below the rate of Classic Advances with a maturity that matches the lockout period of the HLB-Option Advance. For example, the 10-year maturity, six-month lockout (putable quarterly) HLB-Option recently priced at 1.89%, 135 basis points below the six-month Classic Advance at 3.24%.

SOFR Flipper Advance

Like the HLB-Option, the SOFR Flipper Advance allows the member to capture cheaper funding rates by selling optionality when volatility is high. However, while the HLB-Option Advance offers a fixed rate, the SOFR Flipper Advance is a floating to fixed borrowing. During the lockout period, the member pays a rate of SOFR less the locked-in and pre-determined spread. If it is not put back at the end of the lockout, the advance then “flips” to a fixed rate.

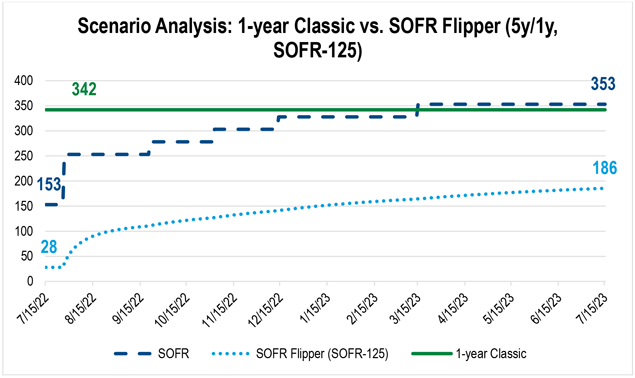

As an example, a SOFR Flipper Advance with a five-year maturity and a one-year lockout recently priced with a floating rate of SOFR less 125 basis points and a flip rate of 2.61%. If we assume SOFR rises by 200 basis points over the next year from the 1.53% level of mid-July, then the rolling average paid in the SOFR Flipper is significantly less than utilizing Classic Advances in this hypothetical example. With short-term rates nearly 100 basis points above the flip rate of 2.61%, it would be probable that the advance would be put back and not flip to the fixed rate.

If short-term rates do not go up by that much, or they go up and the Fed is forced to pivot to rate cuts, then it would be more likely that the advance would flip. However, that would be offset by lower cumulative interest costs for that first year. Given that profile, a potential approach would be to utilize the SOFR Flipper as part of a holistic balance sheet strategy to add asset duration (via fixed-rate loans or investments) to improve metrics in down-rate scenarios. For example, an asset yielding 4.50% could produce 250-400 basis points of net spread during the floating period, and still almost 200 basis points if the advance flipped to the fixed rate.

Flexible Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact me at 617-292-9644 or andrew.paolillo@fhlbboston.com or reach out to your relationship manager for more details.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing.. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.