Deposit Costs and Gradual Policy Rate Reduction

Bank deposits exhibit convexity. How effectively a depository can pass on changes in Federal Reserve policy rates to customers is influenced by how quickly the policy rate shifts. The current rate-cutting cycle differs from 2020 because rates are higher, and the pace of rate cuts is more gradual and predictable. With the Fed signaling a slower pace of rate cuts, it may be appropriate for members to consider the relative costs of all available funding sources, including FHLBank Boston advances.

Cost of Funds Changes

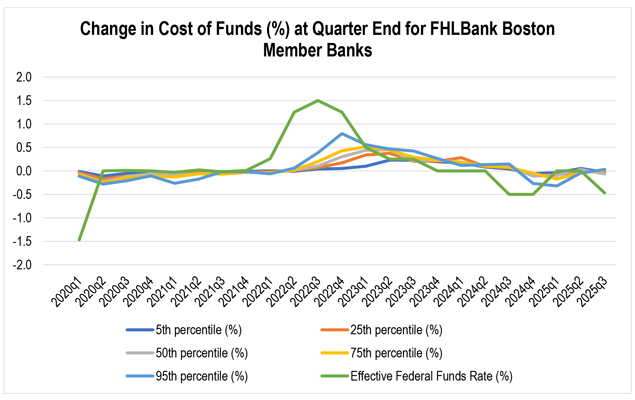

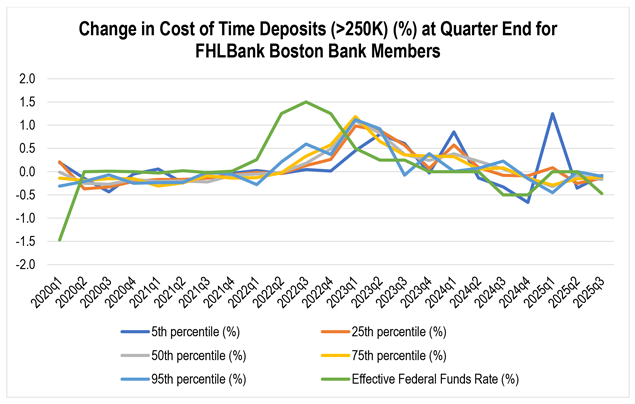

The charts below show the change in the cost of funds for FHLBank Boston member banks, as well as the change in the effective federal funds rate for each quarter since the start of 2020. In each chart, the 5th, 25th, 50th, 75th, and 95th percentiles of cost are shown. Examining this level of detail can be helpful in revealing trends that are appropriate to your specific business model.

We show three different time series: the cost of funds, the cost of interest-bearing transactional accounts, and the cost of time deposits less than $250,000. The levels of these costs differ, so the changes in each vary. Nonetheless, three key themes emerge from the data:

- The rate of change of the effective federal funds rate matters for pricing deposits.

It’s not just the level of interest rates that matters for deposit pricing, but also the rate of change, demonstrating deposit convexity. Deposit duration is uncertain, as predicting consumer behavior is difficult, particularly given the rapid pace of technological change in the financial sector. Over the most recent hiking cycle, large increases in the cost of funds did not occur until late 2022, when the Fed rapidly increased policy rates and interest-rate volatility was elevated. This was true even for banks that priced deposits aggressively. - The precipitous decline in policy rates in 2020 may not provide much guidance for this cutting cycle.

When the Fed abruptly cut rates at the beginning of the COVID-19 pandemic, the cost of funds for FHLBank Boston member banks did not decline much because costs had not increased much during the previous gradual and well-telegraphed hiking cycle. The current rate-cutting cycle differs from 2020 because deposit costs are much higher and have more room to fall. Also, the pace of rate cuts has been slower as anticipated, so interest-rate volatility is lower. - In the most recent quarter, the decline in policy rates was not obviously passed through to deposit costs.

In the third quarter of 2025, the effective federal funds rate declined, but the cost of funds for FHLBank Boston members barely moved down. In fact, the changes in the 75th and 95th percentiles for interest-bearing transaction accounts were positive. While the numbers are small and the sample is small enough not to dwell on too much, they do show that member banks that are competitively pricing deposits are not passing on recent reductions in the policy rate.

Unclear Pace of Incremental Rate Reductions

Amid the heightened deposit competition exacerbated by technology and a low-volatility rate-cutting cycle, depositories can’t assume lower deposit costs are on the horizon. This is particularly true because the Fed used its December Federal Open Market Committee (FOMC) meeting to push back against the idea that further rate cuts are likely in the near term. Chairman Jerome Powell repeatedly stated that the current policy rate is within the broad range of estimates of the “neutral” rate. This implies that some Committee members believe the current level of rates is no longer restrictive. Indeed, two FOMC members dissented against the rate cut in December, preferring not to reduce rates.

Advances for Managing Your Cost of Funds

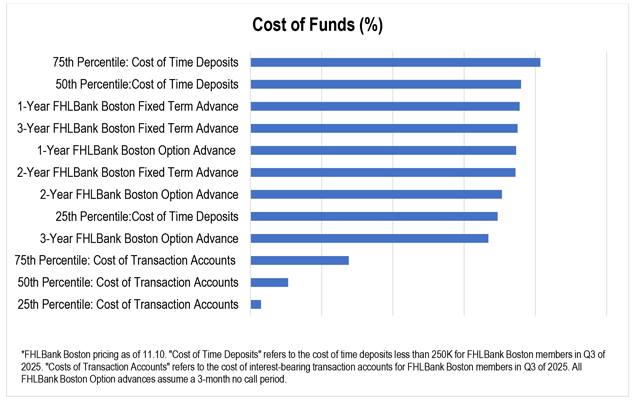

If deposit costs decline more slowly than forecast, it may be appropriate to consider the optimal funding mix for your institution. The chart below shows the relative costs of FHLBank Boston’s Classic Advances and HLB-Option Advances at various tenors compared to the 25th, 50th, and 75th percentiles of the cost of funds for time deposits less than $250,000 and interest-bearing transaction accounts. For interest-bearing transaction accounts, the cost of funds is lower than the cost of an advance. However, depending on the tenor and percentile, some FHLBank Boston advances offer lower costs of funds than time deposits.

If deposit costs decline more slowly than forecast, it may be appropriate to consider the optimal funding mix for your institution.

Advances with embedded options, like the HLB-Option Advance, are customizable. The member and FHLBank Boston agree to a “lockout” period in which the option cannot be exercised, and the agreed-upon funding rate is guaranteed. After that lock-out period, whichever party holds the option can exercise it until the advance matures.

With the HLB-Option Advance, FHLBank Boston has the option to end the advance at the conclusion of the lock-out period. FHLBank Boston will typically exercise this option if interest rates increase. Because FHLBank Boston holds the option, the rate on an HLB-Option Advance generally is lower than a Classic Advance for the same term. It’s important to understand that funding is secured only for the lock-out period, not for the entire term of the advance.

Caroline Casavant

Caroline helps members understand how economic and financial developments may affect their balance sheet risks and determine how FHLBank Boston can partner with them to manage those risks. Please contact her at 617-292-9735 or caroline.casavant@fhlbboston.com or reach out to your relationship manager for more details.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances.

Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing. The words “expects”, “may”, “likely”, “continue”, “possible”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications and economic conditions (including effects on, among other things, interest rates and yield curves). The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein, or that may be made from time to time on behalf of the Bank.