Introducing the SOFR Flipper and Callable SOFR-Indexed Floater Advances

FHLBank Boston is pleased to add two new advance products to help members meet their funding needs.

Ongoing Shift Away From LIBOR

As part of the multi-year transition away from LIBOR to alternative indices, FHLBank Boston continues to expand its product offerings by adding new SOFR-based advances. The SOFR Flipper Advance and the Callable SOFR-Indexed Floater Advance join the SOFR-Indexed Advance as advance solutions that reference the index that the Alternative Reference Rate Committee (ARRC) has endorsed as the preferred replacement for LIBOR.

As a refresher, SOFR stands for the Secured Overnight Financing Rate. SOFR reflects the cost to borrow money in a repurchase (repo) transaction, where the term is overnight and collateralized by Treasury securities. This differs from LIBOR, which is the cost to borrow money in the interbank market at terms such as one- or three-month, and on an unsecured basis. In contrast to LIBOR, which is calculated through submissions from global banks who estimate the cost for money at a particular tenor, SOFR reflects actual transactions occurring in the trillion dollar repo market and is calculated and reported by the Federal Reserve Bank of New York.

Let’s take a closer look at the structure of the two new advance types and ways that members can best utilize them as part of their balance sheet management.

SOFR Flipper Advance

There are two main characteristics to the SOFR Flipper Advance. First, it involves the member selling the option to FHLBank Boston for the right to cancel the advance at predetermined dates, which helps to reduce the rate paid by the member. Second, it has a floating-to-fixed coupon structure. This means that during the designated lockout period, the rate will adjust at SOFR minus a spread. If the advance is not cancelled at the end of the lockout period, it will convert, or flip, to a predetermined fixed rate.

All else equal, a longer final maturity, shorter lockout period and greater put frequency will lead to more value (i.e., a lower rate) from selling the option. Additionally, higher interest-rate volatility will also lead to a lower rate.

| Feature | Less Benefit from Optionality | More Benefit from Opportunity |

|---|---|---|

| Final Maturity | Shorter Maturity | Longer maturity |

| Lockout Period | Longer lockout | Shorter lockout |

| Put Frequency | Less often (i.e. 1x) | More often (i.e. quarterly) |

| Interest-Rate Volatility | Less market volatility | More market volatility |

Aside from being able to tailor the maturity, lockout, and put frequency, the member can also determine the spread to SOFR for the floating period. The greater the spread discount to SOFR, the higher the fixed-rate coupon on the back end. This ability to customize may be of value when short-term rates move higher and further away from zero, as is currently forecast to occur in 2022.

Both new advances allow members more choices for advances based on the SOFR index, and each is unique in its ability to provide for flexibility based on your funding needs.

Let’s look at an example of a SOFR Flipper with the following features:

- Five-year final maturity

- Six-month lockout period

- Puttable quarterly after lockout period

- Spread of 5 basis points during the floating period

- A coupon of 1.28% during the fixed period

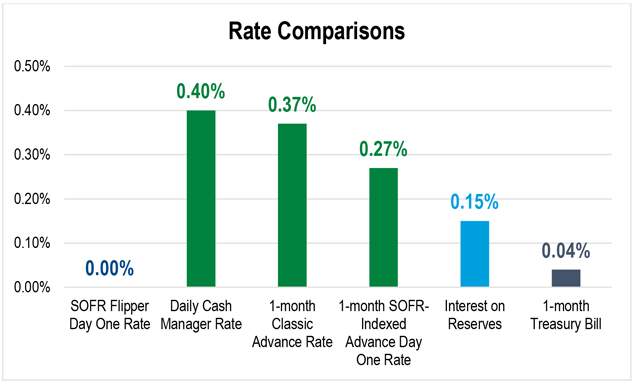

If SOFR is at 0.05%, the starting rate for the SOFR Flipper Advance would be 0% (0.05% rate minus the 0.05% spread). That is below the current level of other instruments, such as short-term advances, interest on reserves and Treasury bills. When factoring in the dividend received from activity stock, the result is an initial all-in negative rate to borrow. If short-term rates begin to rise ─ as is currently being priced into market expectations ─ then the rate on the SOFR Flipper will as well. However, as referenced above, the 5-basis point spread allows the SOFR Flipper rate to lag other short-term borrowing alternatives, which price at a positive spread to SOFR.

Whether the advance will be canceled at the end of the lockout period will be determined by the level and shape of the yield curve at that time, as well as that of interest-rate volatility. Higher rates and/or lower volatility typically lead to an increased likelihood of the put being exercised. You can see how the optionality works to lower the rate, when comparing the fixed leg of the SOFR Flipper and the current comparable maturity Classic Advance. A five-year/six-month SOFR Flipper will have 4.5 years remaining at the end of the lockout period; the 1.28% fixed leg is 68 basis points below the 1.96% rate on a current 4.5-year Classic Advance.

The SOFR Flipper can be particularly beneficial to members looking for margin relief with the flexibility to have the advance’s average life contract (in rising rates) or expand (in declining rates). Additionally, asset-sensitive members may find value in using the SOFR Flipper in a duration mismatched investment leverage strategy. The discounted rate versus other short-term or floating-rate options enhances the initial spread; the asset being longer than the funding benefits the member in down-rate scenarios and the balance sheet’s natural asset sensitivity in rising rates mitigates the impact in up-rate scenarios.

Callable SOFR-Indexed Floater Advance

The Callable SOFR-Indexed Floater Advance is similar to the SOFR-Indexed Advance. The key difference is that the callable version gives the member the ability to cancel the advance on specified dates prior to maturity.

There is still value in funding with floating rates even though the Fed is expected to aggressively raise rates in 2022. The front-end of the yield curve has adjusted and steepened to reflect the consensus of soon-to-be rising rates, and as such, fixed-rate costs have gotten more expensive.

Let’s look at an example where the Callable SOFR-Indexed Floater Advance can offer relative value versus the Classic Advance. We can compare the total interest costs for a Callable SOFR-Indexed Floater with a seven-month maturity and a call option at the six-month mark (priced at SOFR +21) and a seven-month Classic at 0.80%. In the table below, we summarize the total interest costs in two different rate hike scenarios. What we notice is that even if the Fed begins hiking rates in March and proceeds to hike at every meeting on the seven-month horizon (for a total of four hikes), the floating rate is the less costly alternative by six basis points. If the Fed hikes just twice in the first half of the year, then the Callable SOFR-Indexed Floater Advance’s outperformance expands to 25 basis points.

| Rate Hikes | Total Interest Cost: Callable SOFR | Total Interest Cost: Classic Advance |

|---|---|---|

| 4x (every meeting): March, May, June, July | 0.74% | 0.80% |

| 2x (every other meeting): March, June | 0.55% | 0.80% |

We can see that holding the Callable SOFR-Indexed Floater Advance to maturity can have value when measured solely against a fixed-rate alternative. Additionally, the callable feature can contribute significantly when factoring in broader balance sheet considerations. Asset paydowns or slower-than-projected loan or investment growth may necessitate a reduction in wholesale funding. The Callable SOFR-Indexed Floater Advance affords the member a way to do that efficiently and reduce cash back to targeted levels.

Alternatively, if asset deployment remains strong, a rise in short-term rates may create opportunities and motivation to adjust the type of funding being used by exercising the option to prepay the advance. Examples might include:

- Extending liabilities in a flatter yield curve environment

- Using the SOFR Flipper Advance to get sub-SOFR funding

- Marketing a money market deposit special below SOFR and Treasury rates

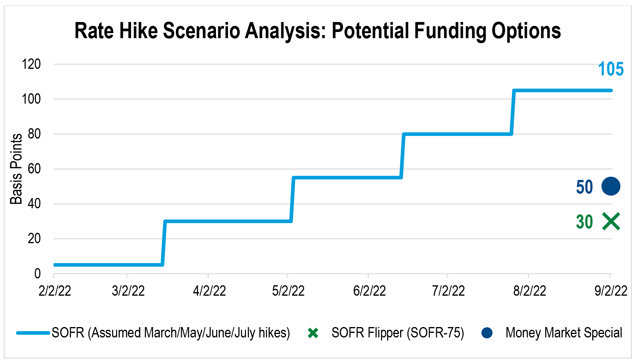

Consider the graph below, using one of the scenarios outlined above ─ four hikes over the next seven months. SOFR would be assumed to be 1.05% at that time. The lift away from 0% could allow for depositories to test the waters with aggressively seeking out deposits via rate specials, a strategy not often employed in 2020 and 2021 as cost of funds and wholesale rates converged. Lastly, as noted above, the member’s ability to tailor SOFR Flipper structures to meet balance sheet needs could offer potential, where a SOFR less 75-basis point floating leg on a SOFR Flipper could offer a very low initial rate at a time when hikes may be slowing down and/or deposit betas could be heating up.

Flexible Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact me at 617-292-9644 or andrew.paolillo@fhlbboston.com or reach out to your relationship manager for more details.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing.. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.