Providing Liquidity in All Environments

The extraordinary events of March 2023 have brought liquidity risk into the limelight. FHLBank Boston has multiple solutions to support members in meeting their funding, liquidity, and risk-management needs.

Fulfilling Our Mission

The first two weeks of March 2023 were a unique time in the markets and banking industry as the FDIC took over a few large banking institutions. Historically, credit risk has been the culprit in most bank failures, but this time was different in that interest-rate and liquidity risks were primarily involved. As the dust settles and markets digest all that has happened in such a short period, there will be opportunities to discuss and dissect specific balance sheet strategies at greater length. But here we highlight the numerous ways that FHLBank Boston provides liquidity to its members, which is a core part of our mission.

Below we cover how FHLBank Boston accepts multiple types of loans and securities as eligible collateral, the varied range of advance products we offer to meet funding needs, the Mortgage Partnership Finance® Program (MPF®), which provides a secondary market outlet for residential loans, and Letters of Credit, which can be used to secure and collateralize large dollar municipal deposits.

Pledged Collateral

To secure an extension of credit with FHLBank Boston, members must pledge enough eligible collateral. For many depository members, residential loans comprise the largest percentage of pledged collateral. Depending on the specific balance sheet, the borrowing capacity afforded from residential loans may often be sufficient to meet everyday borrowing requirements and support contingent funding needs. However, it’s important to note that other loan types can also be pledged. FHLBank Boston accepts commercial real estate and home equity loans, which further bolsters the ability to borrow if and when needed.

FHLBank Boston also accepts different types of securities, including Treasurys, agencies, residential mortgage-backed securities (MBS), commercial MBS, and municipal securities. Many depositories typically elect not to pledge securities, retaining them on the balance sheet unencumbered so that they remain readily salable and contribute to the liquidity-ratio calculation. But as the path of interest rates has pushed many portfolios into unrealized loss positions, cash flow from investments is muted, and salability may be reduced as many are reluctant to sell bonds at steep losses. Pledging bonds can be a key step to enhance liability-side and total liquidity.

| Securities | Use Member-Option Advance |

|---|---|

| Treasurys | Residential Loans |

| Agencies | Commercial Real Estate Loans |

| Residential MBS | Home Equity Loans |

| Commercial MBS |

In this heightened period of liquidity risk, maximizing borrowing capacity can be crucial for navigating periods of volatility and uncertainty. If you have eligible loan types and/or securities on the balance sheet that are not being pledged, reach out to your relationship manager to discuss ways to increase borrowing capacity.

The combination of challenging deposit growth, exceptional loan growth, and unrealized losses on securities has led to a greater need for wholesale funding on most balance sheets.

On-Demand Access to Advances

As we have discussed in articles and our February 2023 webinar, over the last few months the combination of challenging deposit growth, exceptional loan growth, and unrealized losses on securities has led to a greater need for wholesale funding on most balance sheets. FHLBank Boston offers advances to members in various structures along all points of the yield curve. Members have borrowed for many different reasons, including to mitigate interest-rate risk, build up liquidity, and simply fund deposit outflows or asset purchases.

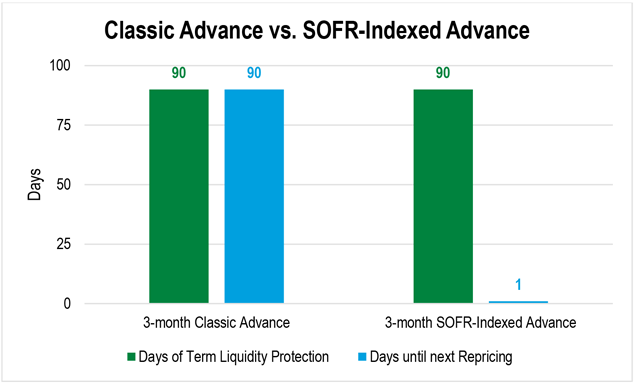

One type of structure beneficial to members in this period of uncertainty is floating-rate advances such as the SOFR-Indexed Advance and the Discount Note Auction-Floater Advance. Term floaters allow members to disintermediate interest-rate risk from liquidity risk. A member may desire a longer average life on their funding but may not want the fixed rate that a Classic Advance affords, preferring a shorter repricing frequency to potentially benefit if the Fed pivots to cutting rates.

The SOFR-Indexed Advance, in particular, can be valuable because of the index and spread components. The SOFR index has been stable and ticked down a few basis points during the extreme volatility of mid-March, which is to be expected, given SOFR’s structure as a risk-free rate. Additionally, compare utilizing a SOFR-Indexed Advance versus a strategy of continually rolling a position in the Daily Cash Manager Advance. The locked-in spread of the SOFR floater minimizes the risk of potentially having to replace funding in volatile periods where spreads may be widening out.

An Outlet for Mortgage Loan Sales

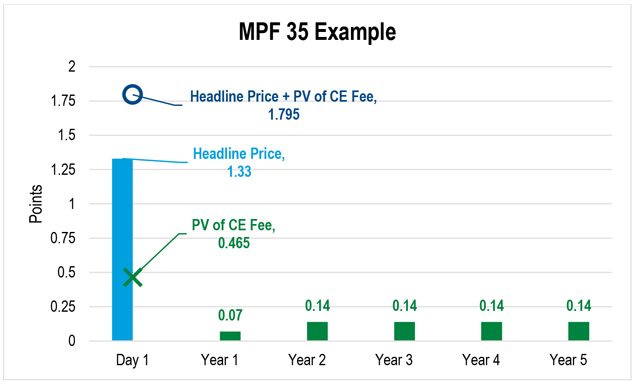

The MPF Program allows members to sell mortgage loan production to FHLBank Boston and produce fee income, reducing the interest rate and liquidity risks that come with holding fixed-rate mortgages on the balance sheet. Unlike other secondary market products, MPF 35 allow the member not just to not only capture an immediate gain on sale, but also continue to earn income as the sold loan performs. For example, a member selling a conventional 30-year mortgage with a rate of 6.50% might receive a headline price of 101.33 (premium of 1.33 points) for selling that loan to MPF 35. However, the Credit Enhancement (CE) fee pays a 7-basis point trailer in year one and then 14 basis points thereafter as long as the loan is still performing. Using an assumption of a five-year expected life on the loan, the present value of the CE fee in this example would be just under 0.50. Similar to factoring in how dividends lower effective borrowing costs when using advances, the CE fee improves the economics of selling loans into the MPF program. To learn more about MPF, contact a member of the MPF team.

Securing Public Deposits

In addition to using pledged collateral to obtain new wholesale funding, members can also use collateral to secure public unit deposit funding through Letters of Credit (LOC). LOCs can be an efficient and cost-effective way to provide municipalities the safety they require for their deposits while ensuring that the funds remain, and are put to work, in local communities and institutions. An LOC can support liquidity metrics because it utilizes off-balance sheet borrowing capacity, which is especially impactful when loans comprise a majority of that collateral pledge. This is in contrast to pledging bonds directly to secure a municipal deposit, which can be more operationally cumbersome than LOCs and negatively affect the on-balance sheet liquidity ratio as the number of unencumbered securities are reduced.

Flexible Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact me at 617-292-9644 or andrew.paolillo@fhlbboston.com or reach out to your relationship manager for more details.

“Mortgage Partnership Finance” and “MPF” are registered trademarks of the Federal Home Loan Bank of Chicago.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing.. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.