Investment Leverage Opportunities

Rising interest rates and widening spreads have presented an opportunity to counteract pressure on earnings caused by extraordinary factors from 2021 subsiding.

Improving Asset Yields

The fourth quarter of 2021 saw a sea change in the timeline for, and magnitude of, expected hikes in the Fed Funds range. In a matter of just a few months, market expectations went from forecasting one to two hikes in 2022, to potentially three or four. The Fed has initiated the tapering of their Treasury and mortgage-backed securities buying program, and after a short period of operating smoothly, they further accelerated the tapering pace. Inflation readings continue to run high, with much debate over whether it’s a short-term effect of current supply chain and labor disruptions, or a more permanent fundamental shift.

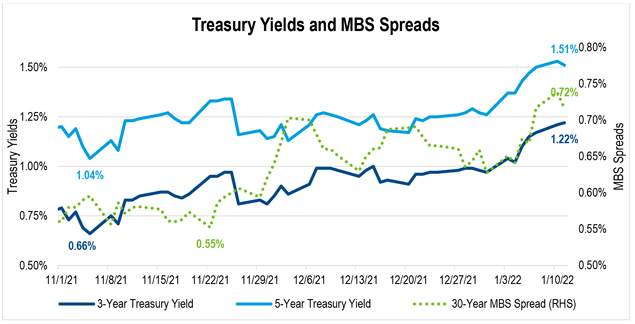

While being an armchair economist is a favorite pastime for many, more practically from our members’ perspectives, ultimately what matters is the available rates on targeted assets and liabilities. In that vein, yields on a popular asset class for depositories, mortgage-backed securities (MBS), have improved considerably of late. The rise in rates has come from both a lift in Treasury yields as well as a widening of spreads.

In addition to the accelerated tapering, recent comments from the Fed have hinted at the possibility that once the tapering of new Treasury and MBS purchases is complete in early/mid 2022, they may begin allowing existing holdings to start to run off as well. Currently, in addition to (tapered) purchases, the Fed is reinvesting principal and interest from the existing portfolio. Stopping that reinvestment would be a continued move towards normalization and repealing of the extraordinary measures enacted in March 2020.

For many, leveraging strong capital levels, enhanced asset sensitivity, and excess liquidity can be a path to combat shrinking margin while still maintaining flexibility.

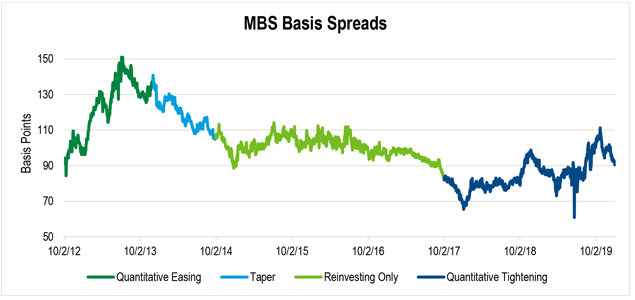

If we look at what occurred during the easing/tightening cycle a decade ago, we can see how MBS spreads reacted differently when the Fed was (a) adding to its balance sheet (Quantitative Easing), (b) slowing down the pace of those purchases (tapering), (c) only reinvesting proceeds, and (d) shrinking their balance sheet (Quantitative Tightening).

Spreads tightened over a multiyear period (albeit from a higher point than where they are at today) during the periods of tapering (light blue section of the line graph above) and reinvesting only (light green) and widened as the Fed shrank its balance sheet (dark blue). The period between when tapering ended and when tightening began was around three years, much longer than what is currently being hinted at. This accelerated timeline may be a key driver of why spreads are widening (and may widen further in the near term) ─ a welcome sight for balance sheet investors like banks and credit unions that have excess liquidity to deploy.

Earnings Pressure

The current benefits of improved MBS yields come at a time when most depositories are grappling with margin compression. The past two years saw strong, and in many cases, record earnings from banks and credit unions, supported by income garnered from the Paycheck Protection Program (PPP), elevated gains on sale from the mortgage refinancing boom, and sharply reduced cost of funds.

But looking toward 2022, balances of PPP gains are nearly exhausted, mortgage banking activity has slowed down (even before the recent rise in rates), and cost of funds has mostly bottomed out while loan yields and growth continue to be pressured. For many, leveraging strong capital levels, enhanced asset sensitivity, and excess liquidity can be a path to combat shrinking margin while still maintaining flexibility.

Funding Strategies

Below we will look at three different advance solutions that can be useful in instituting an investment leverage program. With yields on 15- and 30-year MBS near 1.75% and 2.50%, respectively, the opportunity exists to earn more than 100 basis points of net spread.

Strategy 1: Using the SOFR-Indexed Advance

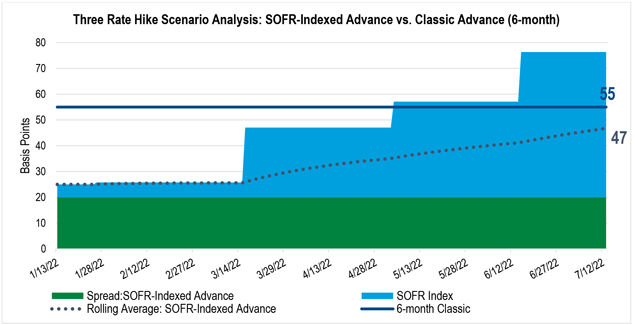

It may seem counterintuitive to seek out floating-rate funding ahead of potential Fed hikes, but current narrow spreads on the SOFR-Indexed Advance create a margin of safety for the floater to outperform the fixed-rate alternative, even as short-term rates begin to rise.

In the example below, a six-month SOFR-Indexed Advance priced at a spread of +20 is compared to using a six-month Classic Advance at 0.55%. Even if the Fed increased rates three times within that six-month timeframe (March, May and June), the total cost for the floating-rate SOFR-Indexed Advance would still be eight basis points less than the fixed-rate Classic Advance. If the pace of hikes moves slower, the outperformance will be even greater.

A common theme of late, from conversations with members, as well through call report analysis, is that many balance sheets are positioned as firmly asset sensitive. This may allow for the ability to naturally absorb the interest-rate mismatch of investing long and funding short. The SOFR-Indexed Advance allows for a cost-efficient alternative that may align with your balance sheet’s interest-rate risk management needs.

Strategy 2: Using the Discount Note Auction-Floater Advance

Another floating-rate alternative, the Discount Note Auction-Floater Advance, provides great flexibility in allowing for the member to prepay the advance at each reset interval (either one month or three months) for no fee. This advance allows for an efficient way to recalibrate funding needs if deposit growth or asset paydowns accelerate.

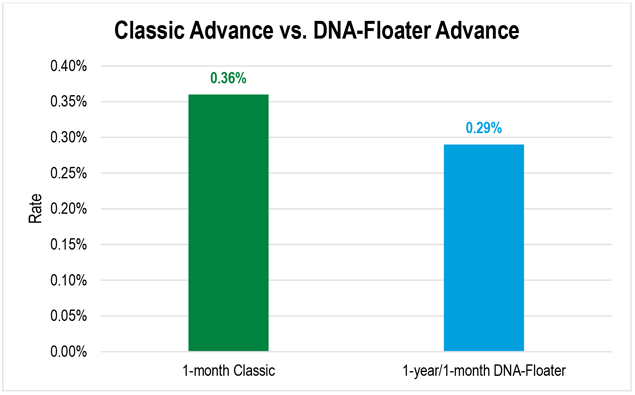

Aside from the flexibility and control, the DNA-Floater presently offers some cost savings compared to the Classic Advance. Compare the one-month Classic Advance at 0.36% versus a DNA-Floater with a one-year maturity and a rate that resets every month, currently priced at a day one all-in rate of 0.29%. The DNA-Floater offers savings of seven basis points for the first month. At the one-month mark, the member has the option to revisit and reassess, which means they can hold it at the attractive spread, pay it down (if funding is no longer needed), or prepay and re-borrow in a new structure if desired (i.e. if a fixed-rate alternative offers better value).

Strategy 3: Using the Member-Option Advance

Despite the recent run-up in intermediate rates, some members may feel their balance sheet positioning calls for mitigation of interest-rate risk, rather than funding at the front end as previously discussed. This may be applicable to institutions that have seen capital levels move lower due to extraordinary deposit growth and/or have already begun to add more long-term assets than is typical to deploy excess liquidity. The Member-Option Advance can be a useful way to extend, but like with the DNA-Floater, retain flexibility to call the funding when it’s in the member’s best interest.

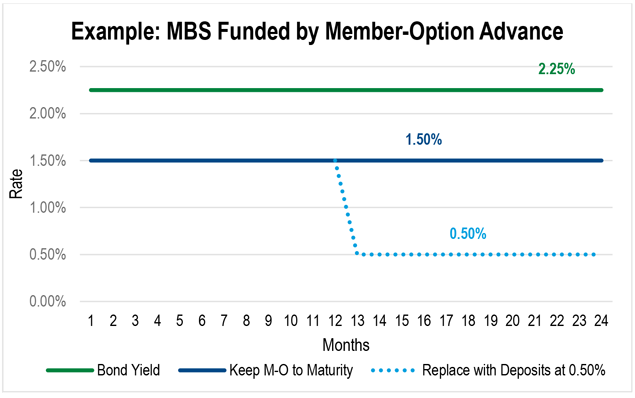

Consider an example where a member buys MBS yielding 2.25% and funds it with a two-year maturity, one-year lockout Member-Option Advance at 1.50%. The strategy would produce 75 basis points of spread for the first year, and the member can elect to prepay the advance after the lockout period. If rates go lower, there may be potential cost savings in re-borrowing (if needed) in a lower rate environment. If rates go higher, the member can elect to retain the advance.

Alternatively, it may be beneficial to call the funding even in an up-rate scenario as deposit betas are likely to remain low for the first few rate hikes. Taking advantage of modest deposit betas might allow the member to replace the funding cheaper even as rates are rising. If four hikes occur, the member could potentially market a deposit special at 0.50%, a fraction of the 100-basis point hypothetical move in short-term rates. This would more than double the spread being earned on the transaction.

Flexible Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact me at 617-292-9644 or andrew.paolillo@fhlbboston.com or reach out to your relationship manager for more details.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing.. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.