Interest-Rate Risk Mitigation with Flexibility

As the prospect of rates being "higher for longer" continues to pick up steam, the Member-Option Advance can be a useful tool to hedge interest-rate risk while maintaining the flexibility to adapt if necessary.

Higher for Longer

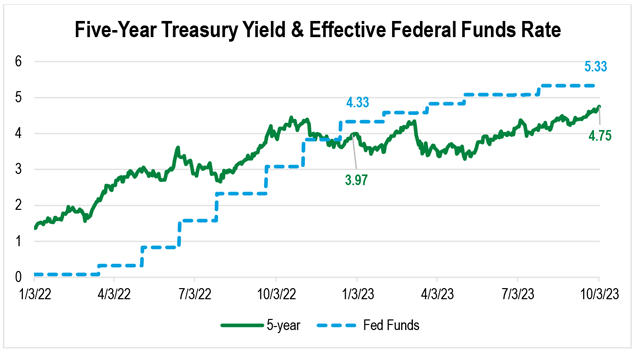

As the Federal Reserve has remained steadfast in raising short-term interest rates to the highest levels seen in over 20 years, the phrase “higher for longer” (H4L) has increasingly become a part of the financial market lexicon. While the path and level of short-term rates have posed (and are likely to continue posing) challenges for deposit retention, growth, and cost, an interesting dynamic has occurred a little further out the yield curve. As the chart below outlines, the yield curve (as measured by the Effective Federal Funds Rate vs. the five-year Treasury yield) inverted in late 2022, after Fed Funds had already risen by over 400 basis points and the five-year had increased by “only” 250 basis points.

This initial phase of the inverted yield curve environment first impacted the asset side of the balance sheet for depositories, as unrealized losses on investments increased significantly, and mortgage refinancing activity slowed considerably. A silver lining was that many banks and credit unions were able to lag deposit rates, so the cost of funds remained modest and margin expanded for most.

But so far in 2023, the effect of H4L has played out on both sides of the balance sheet – deposit betas are accelerating, and the intermediate part of the curve has continued to rise, albeit not to the extreme seen in 2022. Year-to-date through the beginning of October 2023, the five-year Treasury has increased another 75 basis points.

This leaves many depositories tasked with a difficult choice: mitigate the pain of H4L by shortening assets and/or extending liabilities and possibly experience some income statement bumps in the road to restructure or position for a pivot in the rate cycle by keeping funding short, adding asset duration and/or convexity?

This leaves many depositories tasked with a difficult choice: mitigate the pain of H4L by shortening assets and/or extending liabilities and possibly experience some income statement bumps in the road to restructure or position for a pivot in the rate cycle by keeping funding short, adding asset duration and/or convexity?

Below are strategies where FHLBank Boston advances can help mitigate the interest-rate risk created by H4L in the present but also retain flexibility for the future if market or balance sheet conditions change.

Member-Option Advance

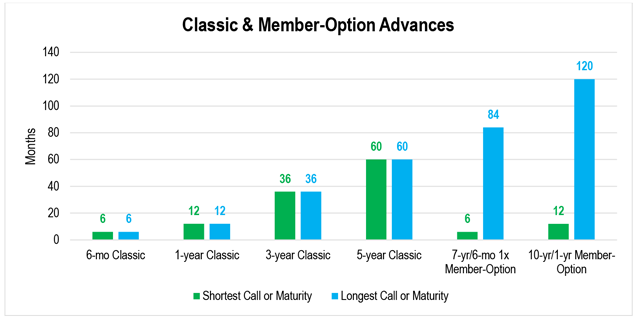

The Member-Option Advance is a fixed-rate advance that allows members to put back the advance (with no prepayment fee) at pre-determined intervals. Members can select the final maturity, the lockout period, and the option frequency – one-time, quarterly, or semi-annually.

In this analysis, two Member-Option structures, a 7-year maturity with a one-time call option after six months (priced at 6.19%), and a 10-year maturity with a one-time call option after 12 months (6.37%), are used. Because the member is purchasing the option to control the timing of the return of principal, the cost for the Member-Option Advance is higher than that of similar-term Classic Advances.

Banks and credit unions can benefit from using these types of advances by reducing exposure to the Economic Value of Equity (EVE for banks) or Net Economic Value (NEV for credit unions) tests. Since the member holds the option to prepay, the duration of the advances is measured according to their respective final maturities. But with the call options at six or 12 months, the member can shorten the advances if so desired.

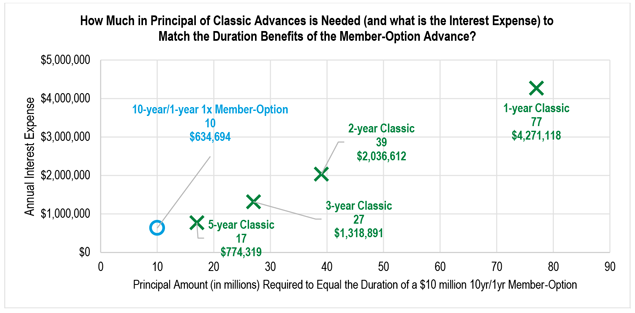

The 10-year maturity Member-Option Advance provides liability duration of around 7.5 years, when calculated using the final maturity of the advance. Knowing the duration of the Member-Option Advance and applying it to a position size of, for example, $10 million can determine how much EVE/NEV support that funding can provide to the balance sheet. After calculating that amount, we can also analyze how much in (shorter duration) Classic Advances would be needed to match the interest-rate risk mitigation benefits of the Member-Option Advance. We can also compare the annual interest expense for those different advance types with different principal amounts.

As outlined in the graph below, the Member-Option Advance, when compared to one-, two-, three- and five-year Classic Advances, requires the least amount of principal to achieve the same dollar duration. This is due to the longer duration of the Member-Option Advance. For example, $39 million of a two-year Classic Advance (with a duration of ~1.9 years) is needed to get the same benefits as $10 million of a Member-Option Advance (with a ~7.5-year duration). Because of the smaller principal amounts, the total interest expense is the lowest for the Member-Option Advance, even as the rate starts with a 6% handle compared to the Classic Advances in the high 4% to mid-5% range.

As the call date approaches, the member must assess whether exercising that option makes sense. It is possible that long-term wholesale funding may not be required at that point, perhaps because shifts in the yield curve or changes in the asset mix mean that mitigating long-term interest-rate risk isn’t as much of a priority as it was in the fourth quarter of 2023. Being able to control that option and reassess within a year provides a leg up compared to other methods of hedging the risk of rates rising and/or staying high.

Blended Funding Strategies

As explained, the Member-Option Advance can provide the most duration at the lowest cost while still maintaining the ability to shorten if desired. But what other funding strategies can supplement the use of the Member-Option Advance?

To use our example from above, if a member used $10 million of a Member-Option Advance but needed $50 million of wholesale funding, what approach could they take to tackle other goals aside from interest-rate risk mitigation, such as reducing funding costs?

Unlike the Member-Option Advance, the HLB-Option Advance enables the member to sell the option to FHLBank Boston to control the timing of the return of principal. Because of that, the cost for the HLB-Option is lower than that of similar-term Classic Advances.

In this environment where funding costs are rising faster than asset yields can reprice, the HLB-Option Advance has been a popular solution for members. Like the Member-Option Advance, the HLB-Option Advance is supremely customizable, and we have seen members use the full range of structures, shorter and longer maturities and lockouts, and one-time or quarterly puts to meet their specific risk and return needs.

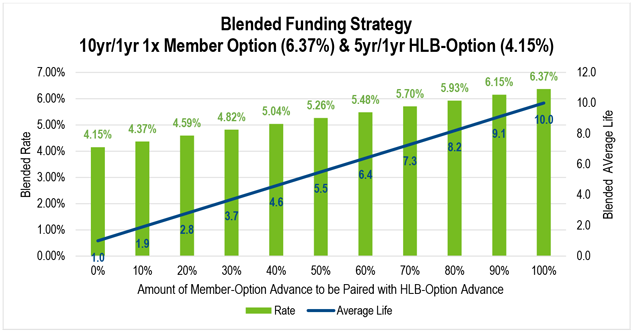

In the example below, we look at what the blended cost and average life might be when constructing a funding portfolio consisting of two advances: the previously mentioned 10yr/1yr one-time Member-Option Advance at 6.37%, and a five-year maturity, one-year lockout HLB-Option Advance with quarterly puts priced at 4.15%. For the Member-Option Advance, the average life is calculated to the longer maturity date because the member controls the option. For the HLB-Option Advance, the average life is calculated to the shorter call date because FHLBank Boston controls the option.

By combining these two advance types, the member can target the cost savings and amount of interest-rate protection that fits the needs of their balance sheet. For example, let’s go back to the case of using $10 million for the Member-Option Advance but still needing an additional $40 million of funding. In this instance, the Member-Option Advance would be utilized for 20% of the funding, and the HLB-Option Advance would be used for the balance, producing a 4.57% blended rate and a 2.8-year average life. By comparison, a Classic Advance with a similar average life was priced at just above 5%, so the blended strategy would provide similar rate protection at a reduced cost. Additionally, aside from the day-one savings, there would be the potential benefit that 20% of the funding would be in a position to be paid off or refinanced to a lower rate in 12 months due to the flexibility afforded by the Member-Option Advance.

Flexible Funding

Recent market conditions have created challenges and opportunities for FHLBank Boston members. Our Financial Strategies group has developed a suite of analytical tools designed to help you identify the funding solutions that best fit the unique needs of your balance sheet. Please contact me at 617-292-9644 or andrew.paolillo@fhlbboston.com or reach out to your relationship manager for more details.

FHLBank Boston does not act as a financial advisor, and members should independently evaluate the suitability and risks of all advances. The content of this article is provided free of charge and is intended for general informational purposes only. FHLBank Boston does not guarantee the accuracy of third-party information displayed in this article, the views expressed herein do not necessarily represent the view of FHLBank Boston or its management, and members should independently evaluate the suitability and risks of all advances. Forward-looking statements: This article uses forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 and is based on our expectations as of the date hereof. All statements, other than statements of historical fact, are “forward-looking statements,” including any statements of the plans, strategies, and objectives for future operations; any statement of belief; and any statements of assumptions underlying any of the foregoing.. The words “expects”, “may”, “likely”, “could”, “to be”, “will,” and similar statements and their negative forms may be used in this article to identify some, but not all, of such forward-looking statements. The Bank cautions that, by their nature, forward-looking statements involve risks and uncertainties, including, but not limited to, the uncertainty relating to the timing and extent of FOMC market actions and communications; economic conditions (including effects on, among other things, interest rates and yield curves); and changes in demand and pricing for advances or consolidated obligations of the Bank or the Federal Home Loan Bank system. The Bank reserves the right to change its plans for any programs for any reason, including but not limited to legislative or regulatory changes, changes in membership, or changes at the discretion of the board of directors. Accordingly, the Bank cautions that actual results could differ materially from those expressed or implied in these forward-looking statements, and you are cautioned not to place undue reliance on such statements. The Bank does not undertake to update any forward-looking statement herein or that may be made from time to time on behalf of the Bank.